What Is a Yearly Budget?

A yearly budget, also known as an annual financial budget, is a detailed plan that outlines your expected income and expenses for the upcoming year. It serves as a financial roadmap that helps you track your spending, identify areas where you can save money, and allocate funds towards your financial goals.

Table of Contents

By creating a yearly budget, you can gain a clear understanding of your financial situation and make informed decisions about how to manage your money.

The Importance of Creating an Annual Financial Budget

Setting up a yearly budget is crucial for maintaining financial stability and achieving your financial goals. Here are some key reasons why creating an annual financial budget is important:

Financial Planning

One of the primary reasons for creating a yearly budget is to facilitate financial planning. By outlining your expected income and expenses for the year, you can anticipate major expenses, such as home repairs, medical bills, or education costs, and set aside funds accordingly. This proactive approach allows you to avoid financial surprises and be better prepared for any unexpected expenses that may arise.

Expense Tracking

Another important aspect of a yearly budget is expense tracking. By comparing your actual spending against your budgeted amounts, you can identify areas where you may be overspending and make adjustments to stay on track. Tracking your expenses also helps you develop a better understanding of your spending habits and enables you to make more informed choices about where to allocate your funds.

Saving for the Future

A yearly budget provides a framework for setting and achieving savings goals. Whether you’re saving for a new car, a dream vacation, or retirement, a budget helps you allocate funds towards your objectives regularly. By incorporating savings goals into your budget, you can build a financial cushion for the future and work towards achieving your long-term aspirations.

Debt Management

For individuals with debt, a yearly budget is an essential tool for managing and reducing debt levels. By including debt repayments in your budget, you can prioritize paying off high-interest loans or credit card balances and avoid accumulating additional debt. A budget helps you stay on track with your debt repayment plan and work towards becoming debt-free.

Financial Awareness

Creating a yearly budget increases your financial awareness and empowers you to make informed decisions about your money. By actively tracking your income and expenses, you can develop a clearer picture of your financial situation and identify opportunities for improvement. This awareness enables you to make smart choices about how to allocate your funds and align your spending with your financial goals.

10 Steps for Setting a Budget

Determine Your Income

Start by calculating your total income for the year, including all sources of revenue such as your salary, bonuses, dividends, rental income, and any other funds you expect to receive. Having a clear understanding of your income is the first step in creating an effective budget.

List Your Expenses

Create a comprehensive list of all your expenses, including both fixed and variable costs. Fixed expenses include recurring costs such as rent or mortgage payments, utilities, insurance premiums, and loan repayments. Variable expenses encompass discretionary spending on items such as groceries, entertainment, dining out, and shopping.

Differentiate Between Needs and Wants

It’s crucial to differentiate between essential needs and wants when setting up your budget. Needs are items that are necessary for your basic well-being, such as food, housing, healthcare, and transportation. Wants, on the other hand, are discretionary purchases that enhance your lifestyle but are not essential for survival.

Set Financial Goals

Define your short-term and long-term financial goals to give your budget purpose and direction. Whether you’re saving for a down payment on a house, building an emergency fund, or planning for retirement, having clear objectives in mind will help you prioritize your spending and make informed decisions about your finances.

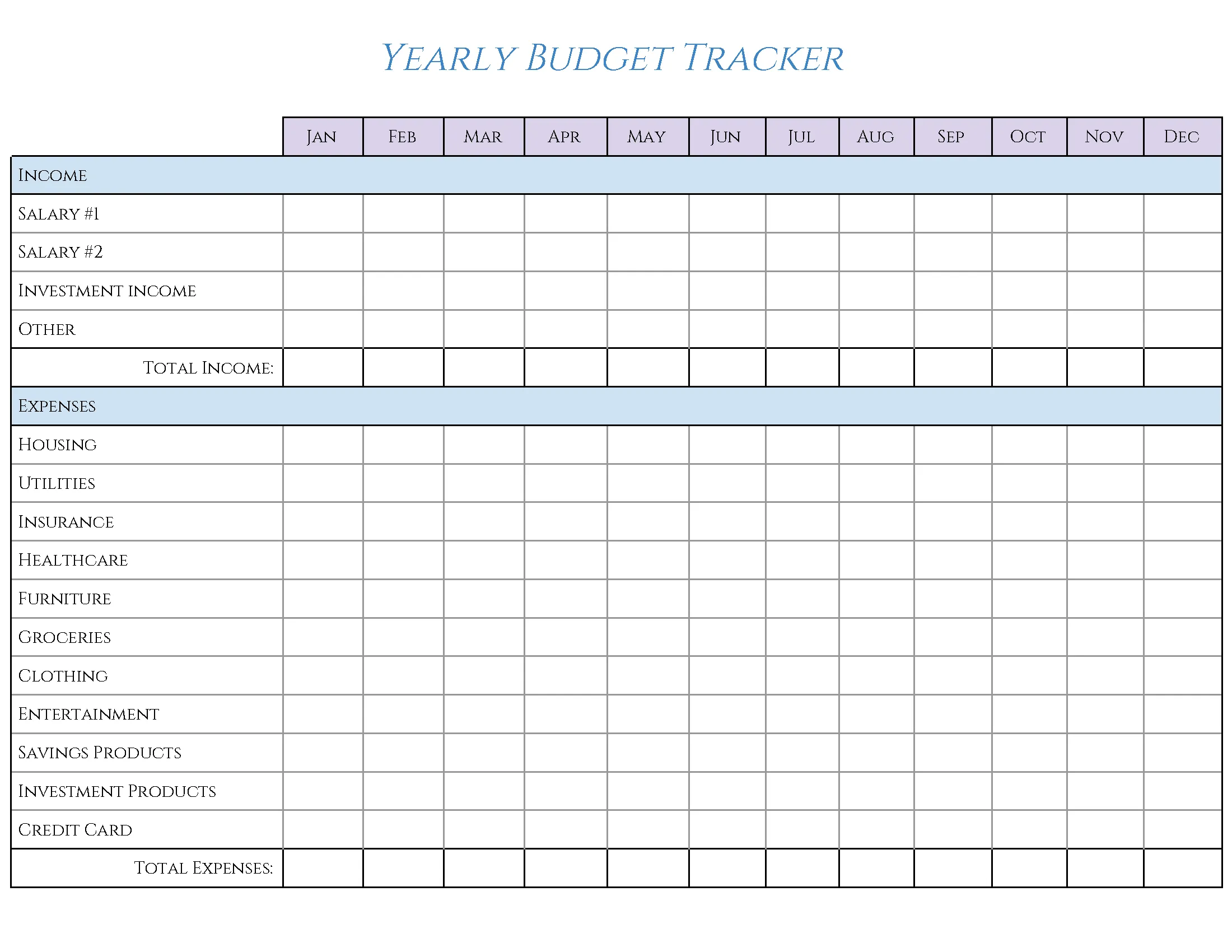

Create a Budget Template

Utilize a spreadsheet, budgeting app, or online tool to create a budget template that outlines your income, expenses, savings goals, and debt repayments. Organize your budget in a clear and structured format that allows you to easily track your financial activity and monitor your progress towards your goals.

Track Your Spending

Regularly monitor your spending habits and compare them to your budgeted amounts to ensure that you’re staying within your financial limits. Tracking your expenses in real-time allows you to identify any areas of overspending and make adjustments to bring your budget back on track. Consider using expense tracking apps or software to streamline this process.

Review and Adjust Your Budget

Periodically review your budget to evaluate your progress towards your financial goals and make necessary adjustments based on changes in your income or expenses. Life circumstances may change, such as a job loss or unexpected medical expenses, requiring you to modify your budget to accommodate these new developments. Flexibility is key to maintaining a functional budget.

Incorporating Flexibility into Your Budget

While it’s essential to have a structured budget in place, it’s equally important to incorporate flexibility into your financial planning. Life is unpredictable, and unexpected expenses or income fluctuations may arise that can impact your budget. By building flexibility into your budget, you can adapt to changing circumstances and ensure that your financial plan remains effective and achievable.

Emergency Fund

One way to introduce flexibility into your budget is by establishing an emergency fund. An emergency fund is a savings account specifically designated for unexpected expenses, such as medical bills, car repairs, or job loss. By setting aside funds for emergencies, you can avoid having to dip into your regular budget or incur high-interest debt to cover unforeseen costs.

Contingency Planning

Include a contingency category in your budget to account for unforeseen expenses that may arise throughout the year. By allocating a portion of your budget to contingency planning, you can prepare for unexpected costs without derailing your overall financial plan. Contingency funds provide a safety net that helps you navigate unexpected financial challenges with ease.

Adjusting Priorities

Be prepared to adjust your budget priorities as needed based on changes in your financial situation or goals. If unexpected expenses arise that require additional funds, you may need to reallocate money from non-essential categories to cover these costs. Flexibility in budgeting allows you to adapt to shifting priorities and ensure that your financial plan remains relevant and effective.

Regular Reviews

Regularly review and assess your budget to ensure that it aligns with your current financial goals and circumstances. Conducting periodic budget evaluations allows you to identify areas for improvement, track your progress towards your objectives, and make informed decisions about how to adjust your budget to meet your evolving needs. Consistent monitoring is key to maintaining a successful budget over time.

Strategies for Maximizing Your Budget

In addition to creating a comprehensive budget, there are several strategies you can implement to maximize the effectiveness of your financial plan and achieve your goals:

Automate Savings

Set up automatic transfers from your checking account to your savings or investment accounts to ensure that you consistently save a portion of your income each month. Automating your savings helps you build a financial cushion without having to rely on willpower to set aside funds manually.

Cut Unnecessary Expenses

Identify areas where you can reduce discretionary spending and cut back on unnecessary expenses to free up more money for savings or debt repayment. Review your budget regularly to pinpoint expenses that can be eliminated or reduced without compromising your quality of life.

Negotiate Bills

Take the time to review your recurring bills, such as cable, internet, and insurance, and negotiate with providers to lower your monthly expenses. Many companies are willing to offer discounts or promotional rates to retain customers, so don’t hesitate to reach out and inquire about potential savings opportunities.

Shop Smart

When making purchases, comparison shop to find the best deals and discounts on items you need. Look for sales, use coupons, and consider buying items in bulk to save money in the long run. By being a savvy shopper, you can stretch your budget further and get more value for your money.

Increase Income

If possible, explore opportunities to increase your income through side gigs, freelance work, or seeking a higher-paying job. Additional sources of revenue can help supplement your budget and accelerate your progress towards achieving your financial goals. Consider leveraging your skills and expertise to generate extra income outside of your primary job.

Plan for the Unexpected

Incorporate a buffer into your budget to account for unexpected expenses or income fluctuations. By having a cushion in place, you can weather financial surprises without derailing your budget or jeopardizing your financial stability. Planning for the unexpected ensures that you’re prepared for whatever comes your way.

Seek Professional Advice

If you’re struggling to create a budget or achieve your financial goals, consider seeking guidance from a financial advisor or counselor. A professional can provide personalized recommendations, help you develop a realistic budget, and offer strategies for improving your financial situation. Don’t hesitate to reach out for assistance if you need help navigating your finances.

Maintaining a Successful Budget Long-Term

Creating a yearly budget is just the first step towards achieving financial stability and reaching your goals. To ensure that your budget remains effective and sustainable over time, it’s important to establish healthy financial habits and maintain consistent financial practices. Here are some tips for maintaining a successful budget long-term:

Regularly Review Your Budget

Set aside time each month to review your budget, track your spending, and assess your progress towards your financial goals. Regular reviews help you stay on top of your finances, identify areas for improvement, and make adjustments as needed to stay on track. Consistent monitoring is key to maintaining a successful budget long-term.

Adjust Your Budget as Needed

Be prepared to adjust your budget as your financial situation changes or unexpected expenses arise. If your income fluctuates, your expenses increase, or your goals shift, be willing to modify your budget accordingly to accommodate these changes. Flexibility and adaptability are essential components of a sustainable budget.

Stay Accountable

Hold yourself accountable for sticking to your budget and achieving your financial goals. Set milestones, track your progress, and celebrate your successes along the way. By staying committed to your budget and holding yourself accountable for your financial decisions, you can build a strong foundation for long-term financial success.

Seek Support

Don’t hesitate to seek support from family, friends, or financial professionals when you need guidance or encouragement. Building a support network of individuals who can help you stay motivated, offer advice, or provide accountability can make a significant difference in your ability to maintain a successful budget long-term. Remember, you’re not alone in your financial journey.

Celebrate Milestones

Recognize and celebrate your financial achievements and milestones along the way. Whether it’s paying off a debt, reaching a savings goal, or staying within your budget for several months in a row, take the time to acknowledge your progress and reward yourself for your hard work. Celebrating your accomplishments can help you stay motivated and committed to your financial goals.

Incorporating Budgeting into Your Lifestyle

Creating a yearly budget is more than just a financial exercise—it’s a lifestyle choice that can positively impact every aspect of your life. By incorporating budgeting into your daily routine and making conscious decisions about how you use your money, you can achieve greater financial security, reduce stress, and work towards achieving your long-term aspirations. Budgeting is not just about numbers; it’s about empowering yourself to take control of your finances and build a brighter financial future.

Yearly Budget Template – EXCEL