Managing your finances can be a challenging task, especially with the constant flow of expenses and financial responsibilities. One effective way to gain better control over your spending and ensure that you are on track with your financial goals is by adopting a weekly budget.

Table of Contents

This approach allows you to break down your income and expenses into smaller, more manageable increments, giving you a clearer picture of where your money is going. By implementing a weekly budget, you can stay ahead of your finances, make informed decisions, and work towards a more stable financial future.

What is a Weekly Budget?

A weekly budget is a detailed financial plan that outlines your income sources, expenses, savings goals, and any other financial commitments on a weekly basis. Unlike a monthly budget, which can sometimes feel overwhelming or difficult to track, a weekly budget provides a more granular view of your finances.

By breaking down your budget into smaller increments, you can monitor your spending more closely, identify patterns or areas for improvement, and make timely adjustments to ensure that you stay within your financial limits.

Why Should You Use a Weekly Budget?

There are several compelling reasons to consider adopting a weekly budget to manage your finances:

Control Over Spending

A weekly budget offers a higher level of control over your spending compared to a monthly budget. By tracking your expenses on a weekly basis, you can identify any potential overspending habits early on and take corrective action before they escalate. This proactive approach allows you to make more informed decisions about where to allocate your funds and avoid unnecessary expenditures.

Early Error Detection

Reviewing your budget on a weekly basis helps you catch any errors or discrepancies early in the month. Whether it’s a miscalculation, a forgotten expense, or an unexpected charge, spotting these issues sooner rather than later gives you the opportunity to address them promptly and prevent them from derailing your financial plan. Early error detection can save you time, money, and stress in the long run.

Alignment with Pay Cycle

For individuals who are paid weekly or bi-weekly, a weekly budget aligns more closely with their income schedule. By structuring your budget weekly, you can better match your expenses to your paychecks, making it easier to plan for upcoming bills, prioritize savings, and manage your cash flow effectively. This alignment can help you avoid cash shortages, late payments, or financial stress related to irregular income streams.

Flexibility and Adaptability

A weekly budget provides greater flexibility and adaptability when it comes to managing your finances. Unexpected costs or financial changes can arise at any time, and having a weekly budget allows you to respond quickly and make necessary adjustments. Whether it’s reallocating funds from one category to another, cutting back on discretionary spending, or increasing your savings contributions, a weekly budget gives you the flexibility to adapt to changing circumstances and stay in control of your financial future.

What to Include in Your Weekly Budget?

When creating a weekly budget, it’s important to consider all aspects of your financial life and include the following elements:

Income

List all sources of income that you expect to receive during the week. This may include your salary, wages, tips, freelance earnings, rental income, or any other money coming in. Be as accurate as possible when estimating your income to ensure that you have a realistic view of your financial resources for the week.

Expenses

Identify all expenses that you anticipate for the week, including fixed costs such as rent or mortgage payments, utilities, insurance premiums, and loan payments. Don’t forget to factor in variable expenses like groceries, transportation, dining out, entertainment, and personal care. By accounting for all of your expenses, you can create a comprehensive budget that reflects your true financial obligations.

Savings Goals

Allocate a portion of your income towards savings goals or financial priorities. Whether you’re saving for a specific purchase, building an emergency fund, planning for retirement, or paying off debt, setting aside funds each week can help you make progress towards your long-term financial objectives. Be specific about your savings goals and track your progress regularly to stay motivated and on track.

Emergency Fund

Include a category in your budget for an emergency fund to cover unexpected expenses or financial emergencies. Having a buffer of savings set aside can provide peace of mind and protect you from having to dip into your regular savings or go into debt when unexpected costs arise. Aim to build up your emergency fund gradually over time to ensure that you have a financial safety net in place.

Debt Repayment

If you have any outstanding debts, such as credit card balances, student loans, or personal loans, be sure to include a section in your budget for debt repayment. Allocate a specific amount each week towards paying down your debts, focusing on high-interest debts first to minimize interest charges and accelerate your debt-free journey. By making regular payments towards your debts, you can work towards becoming financially free and improving your overall financial health.

Flexible Spending

Allow for some flexibility in your budget to account for unexpected expenses or discretionary spending. While it’s important to stick to your budget as much as possible, life is unpredictable, and there may be times when you need to adjust your spending priorities. By including a category for flexible spending in your budget, you can accommodate unforeseen costs without derailing your financial plan or feeling guilty about deviating from your budgeted amounts.

How to Implement a Weekly Budget

Implementing a weekly budget requires discipline, organization, and commitment. Follow these steps to create and maintain an effective weekly budget:

Track Your Expenses

Keep a detailed record of all your expenses throughout the week, including small purchases, online transactions, and recurring bills. Use a notebook, spreadsheet, budgeting app, or financial software to track your expenses accurately and categorize them according to your budget categories. By monitoring your spending closely, you can identify any areas where you may be overspending and make adjustments to stay within your budget limits.

Set Realistic Goals

Establish achievable savings goals, debt repayment targets, and financial milestones that you want to reach each week. Break down your goals into smaller, manageable steps that you can track and measure regularly. Whether you’re aiming to save a specific amount, pay off a credit card balance, or build an emergency fund, having clear objectives can keep you motivated and focused on your financial priorities.

Review and Adjust Your Budget

At the end of each week, review your budget and compare your actual spending to your budgeted amounts. Identify any discrepancies, overspending, or underspending in your budget categories and make adjustments accordingly. If you find that you consistently overspend in certain areas, consider reallocating funds from other categories or finding ways to cut back

Stay Disciplined

Sticking to your budget requires discipline and self-control. Avoid making impulse purchases or unnecessary expenses that are not aligned with your financial goals. Remind yourself of the reasons why you set up a budget in the first place and stay focused on your long-term objectives. Consider establishing a reward system for yourself when you meet your budgeting targets to stay motivated and disciplined in your financial behavior.

Seek Guidance

If you find budgeting challenging or need help managing your finances, don’t hesitate to seek guidance from a financial advisor, counselor, or trusted friend. A professional can offer personalized advice, strategies, and tips to help you create a budget that works for your unique financial situation. They can also provide accountability and support to keep you on track with your budgeting goals and offer solutions to any financial challenges you may encounter along the way.

Celebrate Milestones

Recognize and celebrate your financial achievements as you reach your savings goals, pay off debts, or make progress towards financial stability. Celebrating milestones, no matter how small, can boost your confidence, motivation, and sense of accomplishment. Whether it’s treating yourself to a small reward, sharing your success with family and friends, or simply acknowledging your progress, taking time to celebrate your financial wins can reinforce positive financial habits and inspire you to continue working towards your goals.

Tips for Successful Weekly Budgeting

Here are some additional tips to help you successfully manage your finances with a weekly budget:

Use Budgeting Tools

Take advantage of online budgeting tools, apps, or software to track your expenses, monitor your progress, and manage your budget effectively. These tools can automate the budgeting process, provide insights into your spending habits, and offer customizable features to suit your financial needs. Explore different budgeting tools available and find one that aligns with your budgeting style and preferences.

Avoid Impulse Purchases

Avoid making impulsive buying decisions or unnecessary purchases that are not in line with your budget. Before making a purchase, ask yourself if it aligns with your financial goals, if it is a necessity, and if it fits within your budget. Practice mindful spending, prioritize your needs over wants, and resist the urge to splurge on items that may derail your budgeting progress.

Communicate with Family

If you share finances with family members or have financial responsibilities together, communicate openly about your budgeting goals, priorities, and challenges. Work together as a team to create a shared budget, make joint financial decisions, and support each other in achieving your financial objectives. By fostering open communication and collaboration, you can strengthen your financial relationship, build trust, and work towards shared financial success.

Stay Flexible

Be prepared to adjust your budget as needed to accommodate unexpected expenses, changes in income, or shifts in your financial situation. Life is unpredictable, and your budget should be flexible enough to adapt to unforeseen circumstances. Review your budget regularly, make changes as necessary, and be willing to reallocate funds or adjust your financial priorities to stay on track with your goals.

Seek Support

If you’re struggling to stick to your budget, seek support from friends, family, or financial professionals who can provide guidance, encouragement, and accountability. Share your budgeting challenges, discuss your financial goals, and seek advice on how to overcome any obstacles you may be facing. Having a support system in place can help you stay motivated, stay accountable, and stay on track with your budgeting goals.

Stay Positive

Maintain a positive attitude towards budgeting and view it as a tool to help you achieve your financial goals and secure your financial future. Focus on the progress you’ve made, celebrate your successes, and learn from any setbacks or challenges you encounter. Approach budgeting as a learning experience, a way to improve your financial literacy, and a means to build a strong financial foundation for yourself and your loved ones.

By adopting a weekly budget and following these tips, you can take control of your finances, manage your spending more effectively, and work towards a more secure financial future. Remember that budgeting is a journey, not a destination, and that consistency, discipline, and perseverance are key to achieving your financial goals. With dedication, commitment, and the right mindset, you can master your finances, build wealth, and create a solid financial plan for the future.

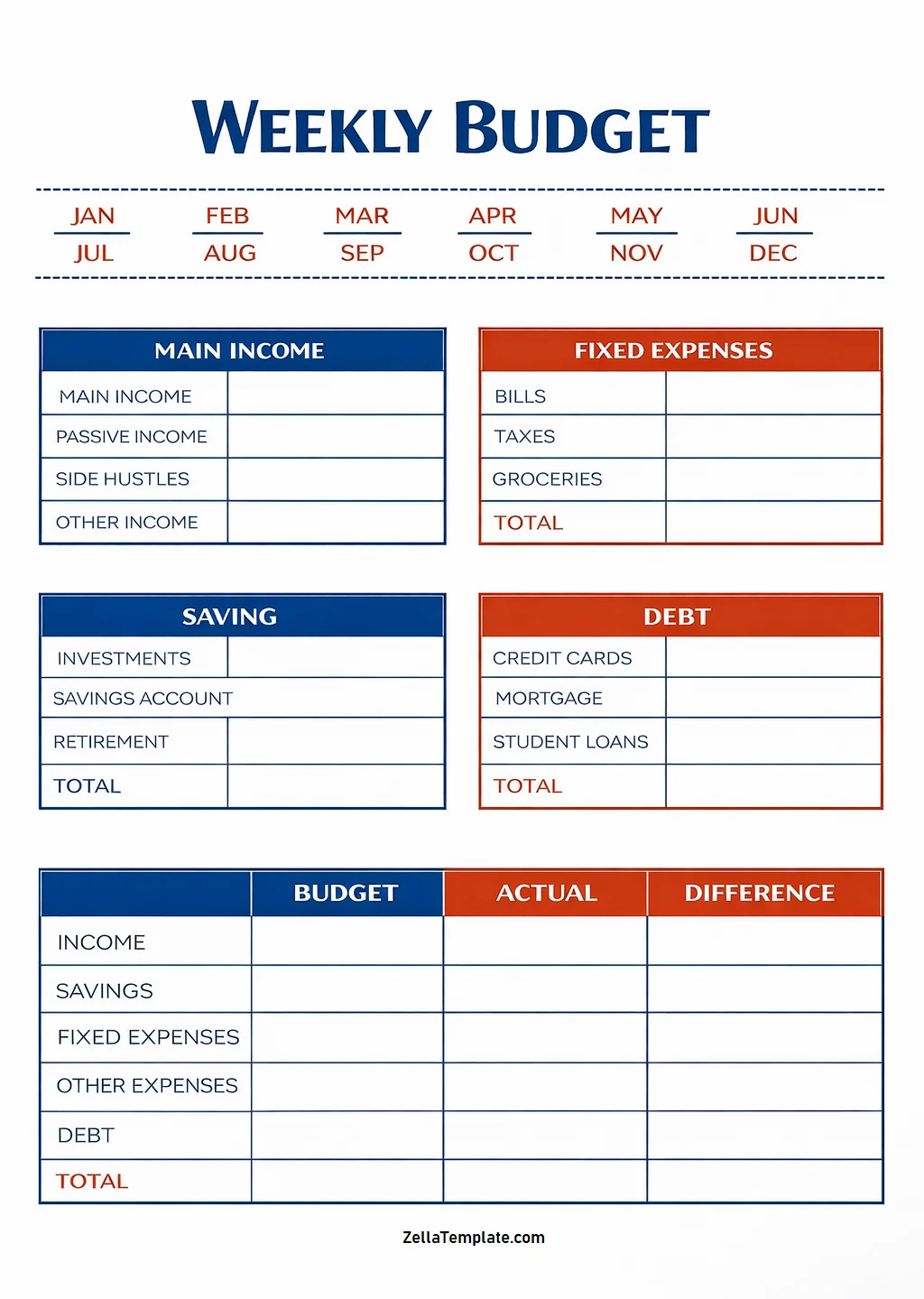

Weekly Budget Template – DOWNLOAD