Table of Contents

When making purchases online, by phone, or setting up recurring payments, credit card authorization forms are essential. They give written permission from the cardholder to a business, allowing charges for a specific transaction or multiple transactions.

They are especially important when the cardholder is not physically present to present their card or provide a signature.

What is a Credit Card Authorization?

A credit card authorization form gives a merchant permission to charge a customer’s credit card for a specific transaction or a series of transactions. It serves as a legally binding agreement between the cardholder and the business, clearly stating the transaction terms and the authorized amount.

Merchants commonly use this form when the cardholder isn’t physically present to provide their card and signature, such as during online purchases, phone orders, or recurring billing arrangements.

For businesses, credit card authorization forms offer protection against fraud and chargebacks. By securing written consent, merchants can prove the customer agreed to the charges, reducing the risk of disputes. This not only protects the business but also gives customers confidence that their credit card information is handled securely and responsibly.

Types of Credit Card Authorizations

There are several types of credit card authorizations that businesses may use, depending on the transaction type and customer preferences. Some common types include:

- One-Time Authorization: Allows a single, specific charge to a customer’s credit card, often used for online or phone purchases.

- Recurring Authorization: Permits repeated charges at regular intervals, commonly used for subscriptions or membership fees.

- Pre-Authorization (Hold): Temporarily holds a specific amount on the card to ensure funds are available, often used by hotels or rental services.

- Incremental Authorization: Used when the final amount isn’t known at the start, allowing businesses to request additional funds as needed (e.g., restaurants or service-based industries).

Each type serves a different purpose and helps ensure a secure, smooth payment process for both businesses and customers.

How Do Credit Card Authorizations Work?

When a customer shares their credit card information with a merchant—whether online, by phone, or in writing—the merchant must obtain the cardholder’s consent to charge the card. This is the purpose of a credit card authorization form.

The cardholder fills out the form with their credit card details, the authorized charge amount, and any other required information. Once the form is submitted, the merchant uses the provided details to process the payment, ensuring the transaction is backed by the cardholder’s clear, written consent.

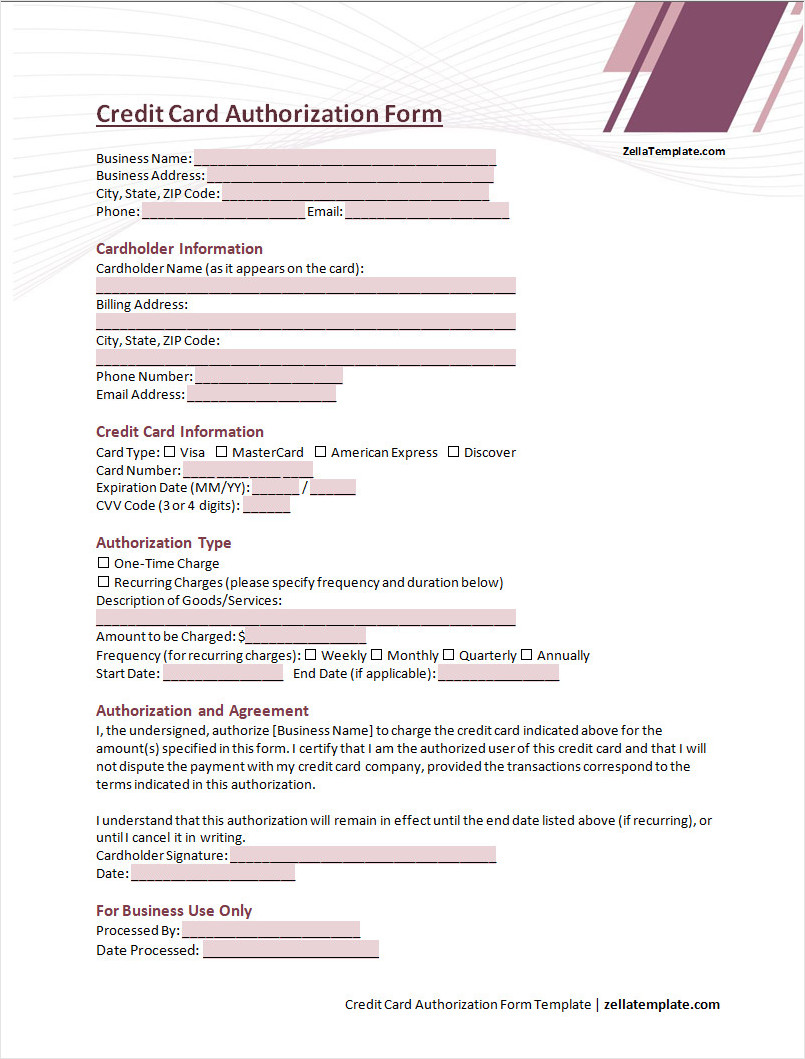

Basic Elements of a Credit Card Authorization

A credit card authorization form typically includes the following basic elements:

1. Cardholder Information

The cardholder information section of a credit card authorization form collects essential details such as the cardholder’s name, billing address, contact information, and credit card number. This information allows merchants to verify the cardholder’s identity, process payments accurately, and communicate clearly about the transaction.

2. Transaction Details

The authorization form includes transaction details specified by the merchant, such as the charge amount, the reason for the charge, and any applicable terms or conditions. This section ensures that both the merchant and the cardholder have a clear understanding of the total cost, the goods or services provided, and any important payment terms or deadlines.

3. Authorization Signature

One of the most important parts of a credit card authorization form is the authorization signature. By signing the form, the cardholder gives formal consent for the transaction and agrees to the terms outlined. This signature acts as a legally binding confirmation that the cardholder approved the charge and accepts responsibility for the payment.

4. Expiration Date

Some credit card authorization forms include an expiration date that defines how long the authorization remains valid for processing payments. This helps businesses manage timelines, ensure they have up-to-date consent from customers, and stay compliant with regulatory requirements. Tracking expiration dates and renewing authorizations when needed helps prevent payment delays or processing issues.

How Long Does a Credit Card Authorization Last?

The validity period of a credit card authorization can vary depending on the business and the type of transaction. In general, authorizations are typically valid for a certain period, such as 30 days or 90 days, after which they may need to be renewed or updated.

Businesses must track expiration dates on authorization forms to ensure they have valid, up-to-date permission to charge the cardholder’s credit card. This helps maintain compliance and prevents unauthorized or declined transactions.

Tips to Remember When Accepting a Credit Card Authorization

When accepting credit card authorizations, it’s important to follow best practices to ensure a smooth and secure transaction process:

1. Verify the Cardholder’s Information

Before processing a credit card authorization, businesses should verify the accuracy of the cardholder’s information on the form. This includes checking the name, billing address, contact details, and credit card number against the cardholder’s records. Proper verification helps prevent fraud and ensures the payment is processed accurately and securely.

2. Securely Store Authorization Forms

Businesses must securely store credit card authorization forms to protect sensitive cardholder data and comply with data security regulations. Whether using locked physical storage or encrypted digital systems, secure storage helps prevent unauthorized access and reduces the risk of data breaches. Strong security practices not only protect customer information but also build trust and demonstrate a commitment to responsible data handling.

3. Follow Payment Processing Regulations

Adhering to payment processing regulations is essential when accepting credit card authorizations. Businesses must comply with guidelines from payment card networks, regulatory bodies, and data security standards to protect cardholder information, prevent fraud, and ensure secure transactions. Staying informed and following these regulations helps businesses reduce risk, maintain compliance, and build lasting customer trust.

4. Communicate Clearly with Customers

Clear communication is essential when accepting credit card authorizations to ensure customers fully understand the terms of the transaction. Businesses should clearly explain how the authorization will be used, disclose any additional charges or fees, and provide contact information for questions or concerns. Transparent communication builds trust, sets expectations, and helps prevent misunderstandings or disputes.

5. Monitor Authorization Expiration Dates

Monitoring the expiration dates of credit card authorizations is crucial for ensuring businesses have up-to-date consent to charge customers’ cards. By tracking expiration dates, businesses can proactively contact customers to renew authorizations, update information, and confirm ongoing transactions. This helps prevent payment issues, supports regulatory compliance, and maintains smooth, uninterrupted service.

Credit Card Authorization Form Template – Word