What is a Letter of Explanation?

When applying for a mortgage, a Letter of Explanation (LOE) serves as a tool for borrowers to provide additional information to lenders. This document allows borrowers to explain any discrepancies or red flags in their application that may affect their loan approval. It is a way to provide context and clarity to potential issues that may arise during the underwriting process.

Table of Contents

Why Do You Need a Letter of Explanation for a Mortgage?

Providing a Letter of Explanation for your mortgage application is essential for several reasons.

1. Addressing Employment Gaps

If you have gaps in your employment history, a Letter of Explanation can help provide context for the lender. By explaining the reasons for the gap and demonstrating that you have since returned to stable employment, you can reassure the lender about your ability to meet your financial obligations.

2. Explaining Late Payments

If you have a history of late payments on your credit report, a LOE can help you explain the circumstances behind these late payments. By providing a detailed explanation and demonstrating that you have taken steps to improve your payment history, you can show the lender that you are a responsible borrower.

3. Clarifying Large Credit Inquiries

If there are multiple recent credit inquiries on your report, a Letter of Explanation can help clarify the reasons for these inquiries. By providing an explanation for the inquiries and demonstrating that they were for legitimate purposes, you can alleviate any concerns the lender may have about your creditworthiness.

4. Building Trust with Lenders

Ultimately, a Letter of Explanation is about building trust with the lender. By being transparent and proactive in providing explanations for any red flags in your application, you can demonstrate your commitment to being a responsible borrower. This transparency can go a long way in helping lenders feel confident about approving your loan.

What to Include In a Letter of Explanation?

When writing a Letter of Explanation for your mortgage application, it is important to include specific details and information that address the lender’s concerns. Providing a thorough explanation can help reassure the lender and increase your chances of loan approval.

1. Clear and Concise Explanation

When explaining any discrepancies in your application, be sure to provide a clear and concise explanation of the issue at hand. Avoid being vague or ambiguous in your explanation, as this may raise more questions than it answers.

2. Solution or Resolution

If applicable, include details about any steps you have taken to resolve the issue or prevent it from happening again in the future. Showing that you have taken proactive measures to address the problem can demonstrate your commitment to responsible financial management.

3. Supporting Documentation

Whenever possible, include supporting documentation that can corroborate your explanation. This may include pay stubs, bank statements, letters of recommendation, or any other relevant documents that can provide additional context to your explanation.

4. Example of Supporting Documentation

For example, if you are explaining a gap in employment, you could include documentation such as tax returns, W-2 forms, or letters from previous employers to validate your explanation. Providing concrete evidence to support your explanation can strengthen your case with the lender.

How to Write a Letter of Explanation for a Mortgage

Writing a compelling Letter of Explanation for your mortgage application requires attention to detail and a clear communication of your circumstances. By following a few key steps, you can create a strong LOE that addresses any concerns the lender may have.

Step 1: Address the Concern

Begin your Letter of Explanation by clearly stating the concern or issue you are addressing. Whether it’s an employment gap, late payment, or credit inquiry, be upfront about the issue and provide context for the lender.

Step 2: Provide Context

Offer a detailed explanation of the circumstances surrounding the issue. Explain why the situation occurred, what steps you have taken to address it, and how it has been resolved or mitigated since then.

Step 3: Be Honest

Above all, be honest and transparent in your explanation. Lenders appreciate honesty and clarity in communication, so avoid embellishing or fabricating information in your LOE. Being honest can help build trust with the lender and strengthen your loan application.

Step 4: Review and Revise

After writing your Letter of Explanation, take the time to review and revise it for clarity and accuracy. Check for any spelling or grammatical errors, and ensure that your explanation is easy to understand and addresses all necessary points. Consider asking a trusted friend or family member to review your LOE for feedback before submitting it to the lender.

What To Do If Your Letter of Explanation is Rejected?

If your Letter of Explanation is rejected by the lender, it’s important not to panic. Take the rejection as an opportunity to review the feedback provided by the lender and make any necessary revisions to strengthen your explanation. Here are some steps you can take if your LOE is rejected:

Step 1: Understand the Reasons for Rejection

First and foremost, understand why your Letter of Explanation was rejected. Review the lender’s feedback and identify any specific concerns or areas for improvement that need to be addressed in your revised LOE.

Step 2: Revise and Expand Your Explanation

Based on the lender’s feedback, revise and expand your explanation in the areas that were flagged for concern. Provide additional context, clarification, or supporting documentation to address the lender’s reservations about your application.

Step 3: Seek Assistance if Needed

If you are struggling to revise your Letter of Explanation on your own, consider seeking assistance from a financial advisor, housing counselor, or mortgage broker. These professionals can provide guidance and expertise to help you strengthen your LOE and increase your chances of loan approval.

Step 4: Communicate with the Lender

If necessary, reach out to the lender to discuss your revised Letter of Explanation and address any remaining concerns they may have. Open communication with the lender can help clarify any misunderstandings and demonstrate your commitment to resolving the issues raised in your application.

Step 5: Stay Positive and Persistent

Finally, stay positive and persistent throughout the process. Rejection of a Letter of Explanation does not mean the end of your mortgage application. By staying proactive and responsive to the lender’s feedback, you can increase your chances of getting your LOE approved and moving forward with your loan application.

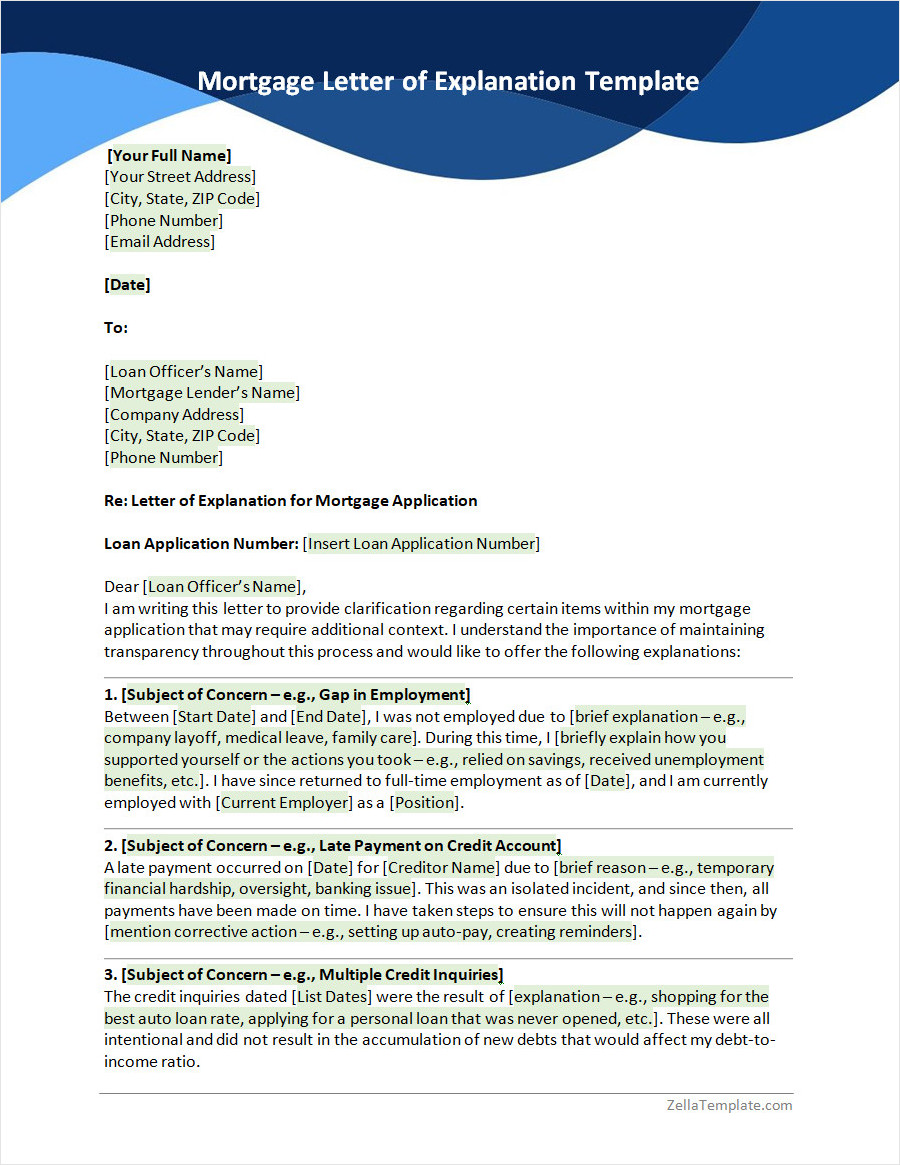

Mortgage Letter of Explanation Template

A mortgage letter of explanation helps clarify financial situations or credit issues that may raise questions during the loan approval process. A well-written letter shows transparency, responsibility, and your commitment to meeting lender requirements.

Use our free mortgage letter of explanation template today to present your case clearly and professionally. Fully customizable and easy to complete—ideal for explaining credit inquiries, missed payments, employment gaps, and more.

Mortgage Letter of Explanation Template – Word