Hold harmless agreements, also called indemnity agreements, help protect parties from potential liabilities, claims, or damages. These contracts shift risk and financial responsibility from one party to another, especially in high-risk situations or where legal claims could occur.

Table of Contents

In this article, we will explore the ins and outs of hold harmless agreements, how they work, their benefits, different types, essential inclusions, examples, and how to write a simple deal.

What is a Hold Harmless Agreement?

A hold harmless agreement is a legal contract where one party agrees to protect the other from certain claims, liabilities, or damages. It shifts the risk from one party to another, often used in situations involving potential legal exposure.

These agreements are legally binding and must meet contract law requirements to be enforceable. By outlining each party’s responsibilities, they help reduce legal risks and provide clarity in case of disputes.

How a Hold Harmless Clause Works

A hold harmless clause outlines when and how one party will protect the other from certain losses, liabilities, or claims. It clearly defines what risks are covered, any exclusions, and the extent of protection offered.

This clause works by shifting responsibility from one party to another. The indemnitor agrees to cover any damages or legal claims related to specified events or actions, helping both parties manage risk and clarify obligations in legally binding terms.

Benefits of Using Hold Harmless Agreements

There are several benefits to using hold harmless agreements in various business transactions or contractual relationships:

1. Risk Management

Hold harmless agreements help manage and divide risk between contracting parties. By clearly stating each party’s responsibilities, they reduce the chance of financial losses from specific events or actions.

These agreements protect against unexpected liabilities and offer a clear process for handling disputes, promoting fairness and legal clarity.

2. Legal Protection

Hold harmless agreements provide legal protection by clearly defining each party’s responsibilities and liabilities in unexpected situations. By outlining the scope of indemnity and obligations, they bring clarity and predictability to legal relationships.

This protection helps prevent disputes and reduces the risks tied to specific activities or transactions.

3. Clarity

Hold harmless clauses clarify the level of protection and the scope of indemnification in case of disputes. They define which liabilities are covered, outline any exclusions or limits, and specify each party’s obligations.

This clear framework helps prevent misunderstandings, supports accurate interpretation, and ensures the agreement can be effectively enforced if legal issues arise.

4. Peace of Mind

A hold harmless agreement provides peace of mind by offering financial protection in specific situations. It clearly outlines each party’s rights and obligations, reducing uncertainty and confusion.

With this legal framework in place, parties can focus on their business with confidence, knowing they are protected against potential risks and liabilities.

Types of Hold Harmless Agreements

There are different types of hold harmless agreements that can be tailored to specific situations or industries. Some common types include:

1. Broad Form

A broad form hold harmless agreement protects the indemnitee from all liabilities, even if they are at fault or negligent. The indemnitor agrees to cover any claims, damages, or losses related to the specified events or activities.

While this offers strong protection for the indemnitee, it places a heavy responsibility on the indemnitor, who assumes full risk under the agreement.

2. Intermediate Form

An intermediate form hold harmless agreement requires the indemnitor to cover liabilities resulting from their actions or negligence. It offers limited protection compared to a broad-form agreement.

The indemnitee is protected from losses caused by the indemnitor but not from issues arising due to the indemnitee’s actions or those of third parties.

3. Limited Form

A limited form hold harmless agreement covers only the specific risks or liabilities stated in the contract. It focuses on particular concerns that the parties agree to address or share.

This type of agreement offers flexibility by allowing the parties to customize the protection based on their unique needs, ensuring clear and targeted risk allocation.

What Should Be Included In Your Hold Harmless Agreement?

When drafting a hold harmless agreement, it is essential to include the following key elements to ensure clarity and enforceability:

1. Identification of Parties

Identify the indemnitor and indemnitee in the agreement. This includes providing the legal names and contact information of each party, as well as specifying their roles and responsibilities under the agreement. By accurately identifying the parties, the agreement becomes legally binding and enforceable, as it delineates the rights and obligations of each party.

2. Scope of Indemnity

Clearly define the specific liabilities, claims, or damages the indemnitor agrees to cover for the indemnitee. This includes listing the events or activities the agreement applies to, the types of risks or losses that are indemnified, and any exclusions or limitations. Defining the scope of indemnity in detail ensures both parties understand their responsibilities and are protected from potential losses linked to specific actions or situations.

3. Limitations

Include clear limitations or exclusions to the indemnification obligations. Specify events or circumstances not covered by the agreement, set caps on the indemnity amount, or define situations where the indemnitor’s responsibilities no longer apply. Adding these limitations helps both parties manage risk effectively and prevents exposure to unlimited or unexpected liabilities.

4. Insurance Requirements

Specify the insurance coverage the indemnitor must maintain to support their indemnification obligations. This may include carrying adequate liability insurance that covers the risks outlined in the agreement. Requiring insurance ensures there is a financial source to handle claims or disputes, providing the indemnitee with added protection and assurance that potential losses can be covered.

5. Additional Terms and Conditions

Include any additional terms or conditions agreed upon by the parties. These may cover dispute resolution methods, governing law, confidentiality obligations, or other relevant provisions tailored to the specific relationship or transaction. Adding these terms ensures the agreement addresses all key concerns and provides a complete framework for managing the parties’ rights and responsibilities.

Examples of Hold Harmless Clauses

Here are a few examples of hold harmless clauses that can be included in agreements:

Example 1

“The indemnitor agrees to indemnify and hold harmless the indemnitee from any claims, damages, or liabilities arising from the use of the product. This indemnification shall apply to any third-party claims or legal actions brought against the indemnitee as a result of the product’s use, including but not limited to product defects, misrepresentations, or negligence on the part of the indemnitor.”

Example 2

“In the event of any legal action against the indemnitee, the indemnitor shall bear all legal costs and expenses. This includes attorney fees, court costs, and any other expenses incurred in defending against such claims. The indemnitor agrees to promptly reimburse the indemnitee for all legal expenses incurred in connection with the legal action, regardless of the outcome or liability involved.”

How Do You Write a Simple Hold Harmless Agreement?

Writing a simple hold harmless agreement involves clearly outlining the responsibilities and obligations of each party in a concise and detailed manner. Here are some steps to follow when drafting a basic agreement:

Step 1: Identify the Parties

Identify the parties involved and their roles in the agreement. This includes providing the legal names and contact information of each party, as well as specifying their roles and responsibilities under the agreement. By accurately identifying the parties, the agreement becomes legally binding and enforceable, as it delineates the rights and obligations of each party.

Step 2: Define the Scope of Indemnity

Define the scope of indemnity by listing the specific risks, liabilities, events, or activities that the agreement covers. Clearly state when one party must indemnify the other, such as in cases of personal injury, property damage, legal claims, or losses caused by negligence, breach of contract, or misconduct. Specify the types of claims or damages included, like legal expenses, settlement costs, or third-party demands. This detailed outline ensures both parties understand their responsibilities and reduces the risk of disputes or unforeseen liabilities.

Step 3: Include Limitations and Exclusions

Include clear limitations or exclusions to the indemnification obligations. Specify any events or circumstances not covered by the agreement, set caps on the amount of indemnity, and outline conditions that may release the indemnitor from responsibility. These limitations help both parties manage risk, prevent excessive liability, and ensure the agreement remains fair and balanced.

Step 4: Specify Insurance Requirements

Specify the insurance coverage the indemnitor must maintain to support their indemnity obligations. This may include securing and maintaining adequate liability insurance that aligns with the risks described in the agreement. Requiring insurance ensures a financial backup is in place to cover claims or disputes, offering the indemnitee an added layer of protection and confidence that potential losses will be covered.

Step 5: Include Additional Terms and Conditions

Include any additional terms and conditions agreed upon by the parties. These may cover dispute resolution procedures, the governing law that will apply, confidentiality requirements, or other relevant provisions. Including these terms ensures the agreement addresses any unique concerns or circumstances, creating a complete and customized understanding between the parties.

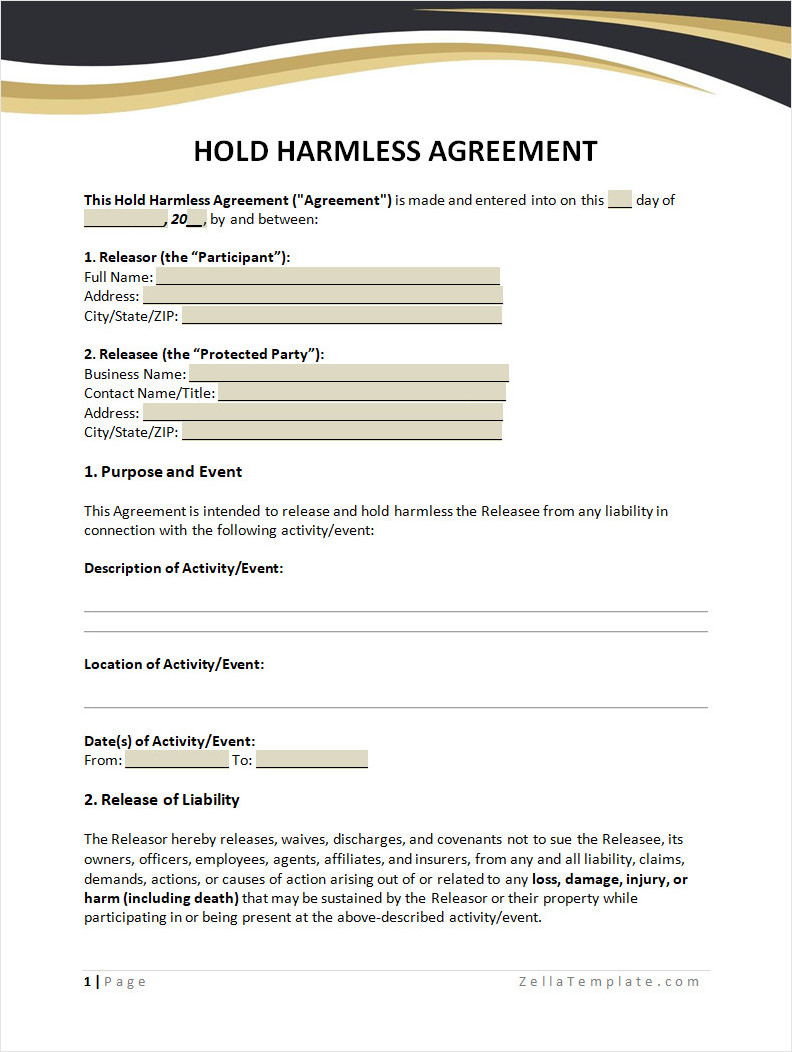

Hold Harmless Agreement Template

A hold harmless agreement is a crucial legal document that helps protect individuals or businesses from liability in various activities, events, or service arrangements. Whether you’re hosting an event, hiring a contractor, or entering into a business deal, having this agreement in place ensures clarity and risk protection for all parties involved.

Use our free hold harmless agreement template today to create a clear, professional, and legally sound agreement. Fully customizable and easy to use—ideal for personal, business, or organizational use.

Hold Harmless Agreement Template – Word