When making large purchases like a home or applying for a business loan, a proof of funds letter is often required. This document shows that the buyer has enough accessible cash to complete the transaction, giving the seller or lender confidence that the funds are real and available.

Table of Contents

This guide will cover what proof of funds letters are, why they matter, the types available, examples, tips, common mistakes to avoid, and more.

What is Proof of Funds?

Proof of funds is a document or statement that shows a person or entity has enough money to complete a transaction.

This proof is typically required when making significant purchases, such as real estate acquisitions, investments, or large-scale business transactions. It is a way to assure the seller or lender that the buyer has the financial capacity to fulfill their obligations.

The Importance of Proof of Funds

Having proof of funds is crucial for both buyers and sellers in a transaction. For sellers, it ensures that the potential buyer is serious and capable of completing the purchase. For buyers, it demonstrates their financial credibility and can help in negotiations and securing favorable terms.

Without proof of funds, the transaction may not proceed smoothly, leading to delays or even cancellations.

When Proof of Funds is Required?

Proof of funds is typically required in high-value transactions where the financial capacity of the buyer is a significant factor. Some common scenarios where proof of funds may be necessary include real estate purchases, investment opportunities, business acquisitions, and loan applications.

By providing proof of funds, the parties involved can proceed with confidence knowing that the funds are available.

Types of Proof of Funds Letters

People use several types of proof of funds letters to demonstrate financial capability. Each type serves a specific purpose and fits different situations. Below are some common types of proof of funds letters:

1. Bank Comfort Letter

A bank issues a Bank Comfort Letter to assure a seller or lender that its client has the necessary funds to complete a transaction. Businesses often use this letter in international trade and large business deals to provide financial assurance and build trust between parties.

2. Bank Readiness Letter

A bank issues a Bank Readiness Letter to confirm its willingness to provide funds for a specific purpose. Buyers often use this letter in real estate transactions to show sellers that they have the necessary funds available to complete the purchase.

3. Blocked Funds Letter

A financial institution issues a Blocked Funds Letter to confirm that funds are available and reserved in an account for a specific purpose. The institution blocks these funds to ensure they are used only for transactions such as a real estate purchase or investment.

4. Verification of Deposit Letter

A bank or financial institution issues a Verification of Deposit Letter to confirm the account holder’s balance and account history. People use this letter as proof of funds in various financial transactions, such as loan applications, real estate deals, or visa processes.

Tips for Building Your Funds for Your Proof of Funds Letter

When preparing a proof of funds letter, it is essential to ensure that your financial documentation is in order. Here are some tips to help you build your funds for your proof of funds letter:

1. Maintain Accurate Financial Records

Keeping detailed and accurate records of your financial accounts, transactions, and investments is crucial when preparing a proof of funds letter. By maintaining up-to-date records, you can easily provide the necessary documentation to support your financial standing.

2. Consolidate Funds for Clarity

If you have funds spread across multiple accounts or investments, consider consolidating them into one primary account for ease of verification. Having all your funds in one place can streamline the proof of funds process and provide a clear picture of your financial resources.

3. Plan for Financial Transactions

Anticipating upcoming financial transactions that may require proof of funds is essential for proper financial planning. By proactively ensuring that your accounts are adequately funded and prepared, you can avoid any delays or complications when providing proof of funds.

4. Seek Professional Guidance

If you are unsure about the requirements or process for preparing a proof of funds letter, consider seeking guidance from financial professionals or advisors. They can help you navigate the documentation needed, ensure accuracy, and provide insights on optimizing your financial resources.

Common Mistakes for Proof of Funds Letters

While providing proof of funds is essential, there are common mistakes that individuals may make when preparing these documents. Here are some common mistakes to avoid:

1. Providing Inaccurate Information

One of the most critical errors in preparing a proof of funds letter is providing inaccurate or outdated information. Ensure that all the details in your proof of funds letter align with your financial records to avoid any discrepancies or misunderstandings.

2. Failure to Update Financial Documentation

Keep your financial documentation current when presenting proof of funds. Make sure bank statements, investment records, and other financial documents are updated regularly to accurately reflect your financial status.

3. Not Consulting with Financial Professionals

If you are unfamiliar with the requirements or best practices for preparing a proof of funds letter, it is advisable to consult with financial professionals. They can provide valuable insights, review your documentation, and ensure that your proof of funds letter meets the necessary standards.

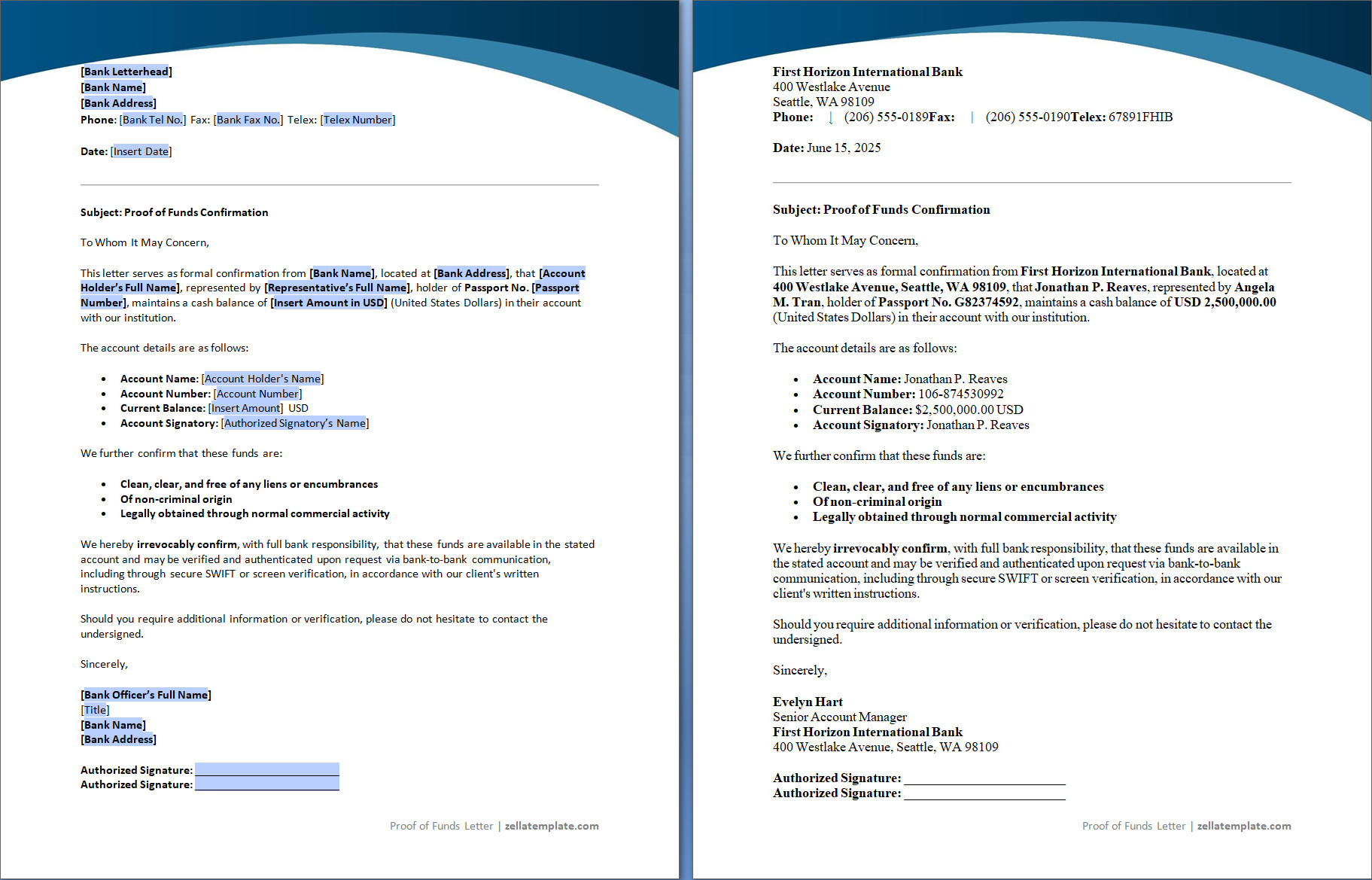

Proof of Funds Letter Template

When applying for a loan, buying property, or making a large investment, showing financial readiness is essential. A clear, professionally written proof of funds letter can speed up approvals and build trust. Our free proof of funds letter template offers a clean, customizable format that meets the standards of banks, real estate agents, and financial institutions.

Save time and present your financial standing confidently—use our free template today.

Proof of Funds Letter Template – Word