When managing rental properties, keeping track of all financial transactions is crucial for both landlords and tenants. One essential tool in this process is the rental ledger, a detailed, chronological record of all rent payments and other financial transactions between a landlord and a tenant.

Table of Contents

In this article, we will explore the significance of rental ledgers in property management and how they benefit both parties involved.

What Is a Rent Ledger?

A rental ledger is a document that serves as a comprehensive record of all financial transactions related to a rental property. It includes details such as rent payments, security deposits, late fees, maintenance costs, and any other expenses incurred during the tenancy.

The ledger is typically updated regularly to ensure accuracy and transparency in the financial dealings between the landlord and the tenant.

Benefits of Using a Rent Ledger

There are several benefits to using a rent ledger in property management:

1. Accuracy

A key benefit of using a rent ledger is its accuracy in tracking all financial transactions for a rental property. Recording each payment, deposit, late fee, and expense helps landlords and tenants avoid discrepancies in their financial records.

2. Transparency

Another key benefit of a rent ledger is the transparency it creates between landlords and tenants. Clear, detailed records make it easy for both parties to review and verify transactions, encouraging trust and open communication.

3. Organized Financial Records

4. Dispute Resolution

In case of disputes over rent or financial matters, a rent ledger is a helpful tool for resolving conflicts. Both landlords and tenants can use it to clarify discrepancies quickly, avoiding misunderstandings and reducing the risk of legal issues.

5. Legal Compliance

Maintaining a rent ledger helps landlords meet legal requirements for financial record-keeping. Accurate documentation ensures compliance and provides essential records for audits or legal issues.

6. Financial Analysis

Using a rent ledger helps landlords analyze the financial performance of their rental properties. Reviewing income and expenses offers insights into profitability, highlights cost-saving opportunities, and supports informed decision-making.

7. Rental Property Maintenance

Another benefit of using a rent ledger is its ability to track maintenance expenses for the rental property, such as routine upkeep like lawn care and filter changes, as well as more involved repairs like fixing a leaky roof or replacing damaged flooring. By recording repair costs and related expenses, landlords can keep the property in good condition and respond to maintenance needs quickly.

8. Tenant Payment Tracking

For tenants, a rent ledger offers a clear view of their payment history and financial obligations throughout the tenancy. It helps track rent payments, deposits, and other expenses, making it easier to manage responsibilities and avoid missed payments.

9. Financial Planning

Both landlords and tenants can use a rent ledger to support financial planning. Landlords can forecast income, track expenses, and set budget goals for their rental properties. Tenants can use it to budget rent payments and manage their finances more effectively.

10. Record Keeping

Using a rent ledger is a reliable way to keep accurate financial records for rental properties. Whether for taxes, legal compliance, or personal budgeting, it offers a clear record of transactions and supports financial accountability at all times.

Items to Include in a Rent Ledger

When creating a rent ledger, it is essential to include the following items to ensure comprehensive and accurate financial tracking:

1. Tenant Information

Include the tenant’s full name, contact details, lease agreement details, and any other relevant information that identifies the tenant associated with the rental property. This information helps track the financial transactions accurately and ensures proper documentation.

2. Rent Payments

Document each rent payment received, including the date of payment, amount paid, method of payment, and any additional notes related to the payment. This detailed record helps track rent payments and ensures that all payments are accounted for in the ledger.

3. Security Deposits

Record the security deposit amount received from the tenant, the date it was received, any deductions made for damages or unpaid rent at the end of the tenancy, and the final disposition of the security deposit. This information helps track security deposit transactions accurately.

4. Late Fees

If late fees are charged for delayed rent payments, make sure to include the details of the late fees in the rent ledger. Document the date the late fee was charged, the reason for the late fee, and the amount of the late fee. This ensures that all late fees are accounted for in the financial records.

5. Maintenance Costs

Include any expenses incurred for maintenance and repairs of the rental property in the rent ledger. Document the date of the expense, a description of the maintenance work performed, the cost of the maintenance, and any receipts or invoices related to the expense. This helps track maintenance costs and ensures that the property is well-maintained.

6. Other Expenses

Document any other expenses related to the tenancy, such as utilities, insurance, property taxes, or other miscellaneous costs. Include the date of the expense, a description of the expense, the amount paid, and any relevant details that identify the expense. This comprehensive record helps track all expenses related to the rental property.

7. Balance Calculation

Calculate the balance of each transaction in the rent ledger to ensure that the financial records are accurate and up-to-date. By calculating the running balance after each transaction, landlords and tenants can track the total amount paid, outstanding balances, and any discrepancies in the financial records.

How Often Should a Rental Property Ledger Be Updated?

It is recommended to update the rental property ledger regularly to ensure accuracy and up-to-date financial records. Landlords should aim to update the ledger every time a rent payment is received, a new expense is incurred, or any other financial transaction takes place. This regular updating helps to maintain transparency and clarity in financial dealings between landlords and tenants.

1. Real-Time Updates

Consider updating the rental property ledger in real-time whenever a financial transaction occurs. By recording transactions promptly, landlords can ensure that the financial records are accurate and reflect the most current information. Real-time updates also help both landlords and tenants stay informed about their financial obligations and payments.

2. Weekly or Monthly Updates

Landlords may choose to update the rent ledger weekly or monthly. A regular schedule helps them stay organized, track transactions efficiently, and ensure all payments and expenses are accurately recorded on time.

3. End-of-Month Reconciliation

At the end of each month, reconcile the rent ledger to confirm all transactions are accurate and balanced. Compare it with bank statements, receipts, invoices, and other financial documents to catch any discrepancies or errors.

4. Annual Review

Conduct an annual review of the rent ledger to evaluate the property’s financial health. Analyze income, expenses, and profitability to spot trends, set financial goals, and make informed decisions for future improvements and investments.

Who Can Use a Rent Ledger?

A rent ledger can be used by various individuals and entities involved in rental property management to track and manage financial transactions:

1. Landlords

Landlords can use a rent ledger to track rent payments, security deposits, expenses, and other financial transactions related to their rental properties.

By maintaining a comprehensive record of all financial transactions, landlords can monitor the financial health of their properties, track income and expenses, and make informed decisions about property management.

2. Tenants

Tenants can use a rent ledger to keep track of their rent payments, security deposits, late fees, and other financial obligations during the tenancy.

By referring to the rent ledger, tenants can ensure that all payments are accurately recorded, track their financial responsibilities, and avoid any disputes or misunderstandings with the landlord.

3. Property Managers

Property managers can use a rent ledger to document and track financial transactions on behalf of landlords and tenants.

By maintaining detailed financial records, property managers can provide accurate reports to landlords, address any payment discrepancies, and ensure compliance with legal requirements related to rental property management.

4. Accountants and Financial Advisors

Accountants and financial advisors can use a rent ledger to assist landlords and tenants with financial planning, tax preparation, and compliance with financial regulations.

By analyzing the information recorded in the rent ledger, accountants and financial advisors can provide guidance on financial matters, identify areas for improvement, and help optimize financial performance.

5. Legal Professionals

Legal professionals, such as lawyers and paralegals, can use a rent ledger as evidence in legal proceedings related to rental property disputes, evictions, or financial conflicts.

By referencing the rent ledger, legal professionals can support their legal arguments, resolve disputes, and ensure that all financial transactions are accurately documented and compliant with legal requirements.

6. Government Agencies

Government agencies like tax authorities or housing regulators may request the rent ledger during audits or compliance checks. Keeping accurate, up-to-date records helps landlords and tenants show legal compliance, prove transactions, and maintain transparency in rental management.

How to Use a Rent Ledger in the Case of an Eviction Action?

In the unfortunate event of an eviction action, a rent ledger can serve as a crucial document to support the legal proceedings:

1. Evidence of Missed Rent Payments

Landlords can use a rent ledger to show proof of missed rent payments. By recording each payment and any late fees, they can demonstrate the tenant’s payment history and any unpaid balances that may justify eviction.

2. Late Fees and Penalties

If late fees or penalties were charged for delayed rent, landlords can use the rent ledger to show the tenant’s payment history and added charges. This helps support eviction cases based on non-payment or lease violations.

3. Notice of Default

Landlords can use the rent ledger to show a tenant’s lease violations. By recording missed payments, late fees, and other issues, the ledger provides clear evidence that the tenant failed to meet financial obligations, supporting the eviction process.

4. Security Deposit Deductions

If security deposit deductions are made at the end of the tenancy due to damages or unpaid rent, landlords can provide documentation from the rent ledger to support these deductions. By detailing the security deposit transactions in the rent ledger, landlords can show the basis for any deductions made and ensure compliance with legal requirements.

5. Legal Compliance

Using the rent ledger in an eviction action helps landlords demonstrate legal compliance with financial record-keeping requirements. By presenting a detailed record of all financial transactions related to the tenancy, landlords can show that they have accurately documented rent payments, expenses, and other financial matters following legal guidelines.

6. Dispute Resolution

In case of any disputes or disagreements related to the eviction action, landlords and tenants can refer to the rent ledger to clarify any payment discrepancies, late fees, or security deposit deductions. By reviewing the information recorded in the rent ledger, both parties can address any financial issues and resolve conflicts effectively.

7. Legal Support

Legal professionals can use the rent ledger as evidence in eviction proceedings to support their legal arguments. By analyzing the financial transactions documented in the rent ledger, legal professionals can build a strong case for eviction based on non-payment of rent, lease violations, or other financial discrepancies that warrant eviction action.

How to Manage a Rent Ledger Form

Managing a rent ledger form involves keeping it organized, updated, and easily accessible for both landlords and tenants:

1. Organization is The Key

Organize the rent ledger form by categorizing financial transactions into different sections, such as rent payments, security deposits, late fees, maintenance costs, and other expenses. This structured format helps track and manage financial records efficiently and ensures that all transactions are accurately documented in the rent ledger.

2. Update Regularly

Regularly update the rent ledger form to reflect the most current financial transactions related to the rental property. Whenever a rent payment is received, an expense is incurred, or any other financial transaction takes place, be sure to update the rent ledger form promptly to maintain accurate and up-to-date financial records.

3. Document Clearly

Ensure that all financial transactions documented in the rent ledger form are clear, detailed, and easy to understand. Use concise descriptions, dates, amounts, and supporting documentation to provide a comprehensive record of all payments, expenses, and other financial matters related to the rental property.

4. Review Regularly

Periodically review the rent ledger form to verify the accuracy of the financial transactions recorded. Cross-check the information in the rent ledger form with bank statements, receipts, invoices, and other financial documents to ensure that all transactions are accurately documented and that there are no discrepancies or errors in the financial records.

5. Backup and Storage

Make digital and physical copies of the rent ledger form and store them in a secure location. Having backups of the rent ledger form ensures that the financial records are safe and accessible in case of any data loss or damage. Store the rent ledger form in a secure location to protect sensitive financial information and ensure that it is readily available when needed.

6. Accessibility

Ensure that the rent ledger form is easily accessible for both landlords and tenants to review and reference as needed. Provide copies of the rent ledger form to tenants, keep a digital version for online access, and maintain a physical copy for easy reference. Accessibility to the rent ledger form promotes transparency and communication in financial matters.

7. Secure Information

Protect sensitive financial information recorded in the rent ledger form by implementing security measures to prevent unauthorized access or data breaches. Use secure storage solutions, password protection, and encryption to safeguard the rent ledger and ensure that confidential financial data remains secure and confidential.

8. Regular Audit

Conduct regular audits of the rent ledger form to verify the accuracy and integrity of the financial records. Review the financial transactions recorded in the rent ledger form, reconcile with other financial documents, and address any discrepancies or errors promptly to maintain reliable and compliant financial records.

9. Training and Education

Provide training and education to landlords, tenants, property managers, and other individuals involved in rental property management on how to use and manage the rent ledger form effectively. Offer guidance on documenting financial transactions, updating the rent ledger form, and resolving any financial issues that may arise during the tenancy.

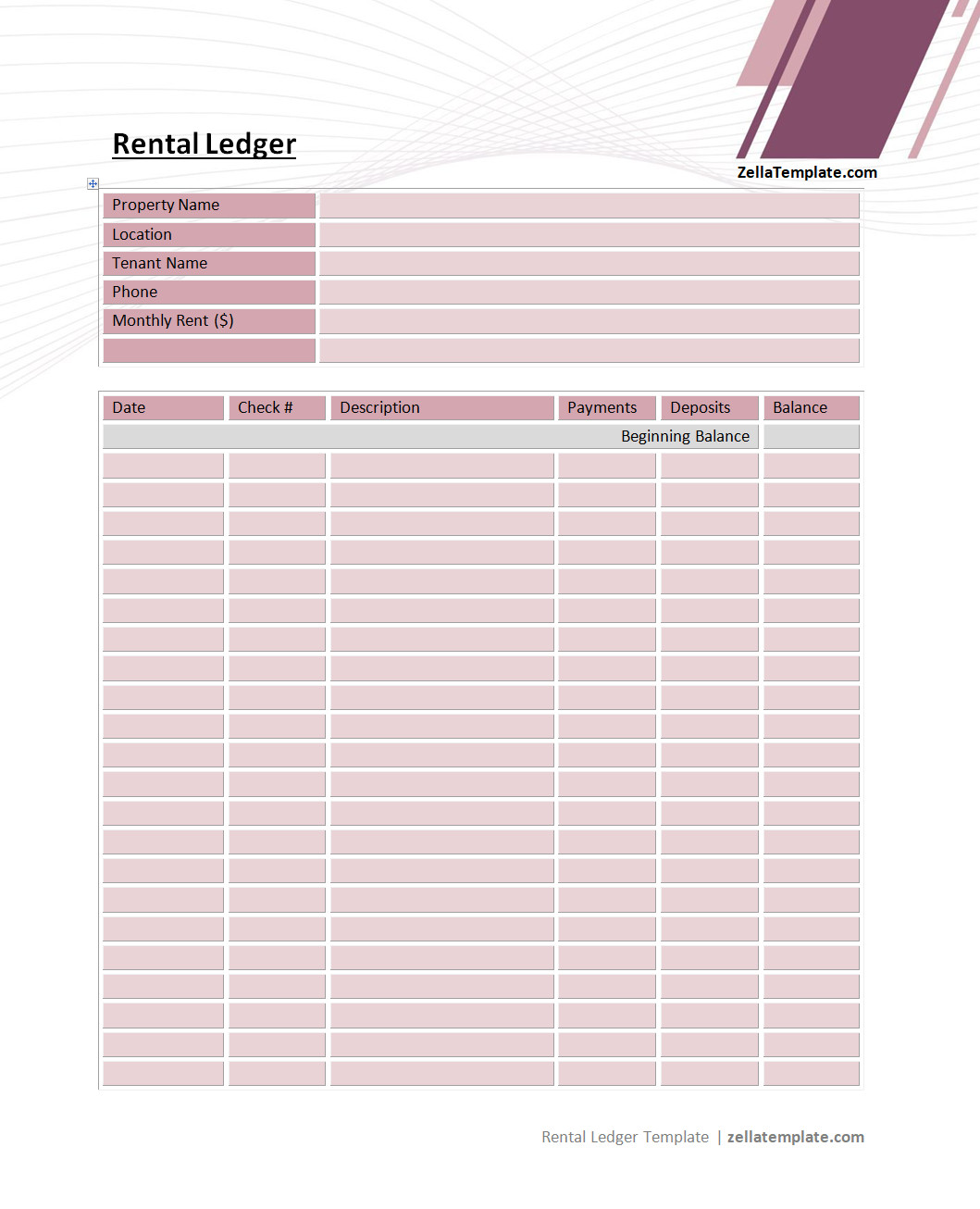

Rent Ledger Template

Keeping accurate records of rental payments is essential for both landlords and tenants. Whether you’re managing a single property or multiple units, a clear and organized ledger helps track rent history, late fees, and balances.

Our rent ledger template makes this process simple and efficient. It’s easy to fill out, fully customizable, and suitable for monthly, weekly, or yearly tracking.

Get our free printable rent ledger template today and take control of your rental records with confidence.

Rental Ledger Template – Word