What is a Year-to-Date Profit and Loss Statement?

A year-to-date profit and loss statement, commonly known as YTD P&L, is a financial document that provides a summary of your company’s financial performance from the beginning of the fiscal year up to the current date. This statement includes details of your revenue, expenses, and net profit or loss over a specific period, giving you valuable insights into your business’s financial health.

Table of Contents

Benefits of YTD P&L Statement

One of the key benefits of a year-to-date profit and loss statement is that it allows you to track your financial performance in real-time. By updating your YTD P&L regularly, you can stay informed about how your business is doing financially and make strategic decisions accordingly. Moreover, the YTD P&L statement serves as a tool for benchmarking your performance against industry standards and competitors, helping you identify areas where you can improve and grow your business.

Another advantage of the YTD P&L statement is its ability to provide a clear picture of your company’s financial position over time. By comparing your current financial data to previous periods, you can assess the trajectory of your business and make adjustments to achieve your financial goals. Additionally, the YTD P&L statement is a valuable resource for communicating your company’s financial performance to stakeholders, investors, and lenders, helping build trust and transparency in your business operations.

Overall, the year-to-date profit and loss statement is a powerful tool that can help you monitor, analyze, and optimize your business’s financial performance, leading to improved decision-making and sustainable growth.

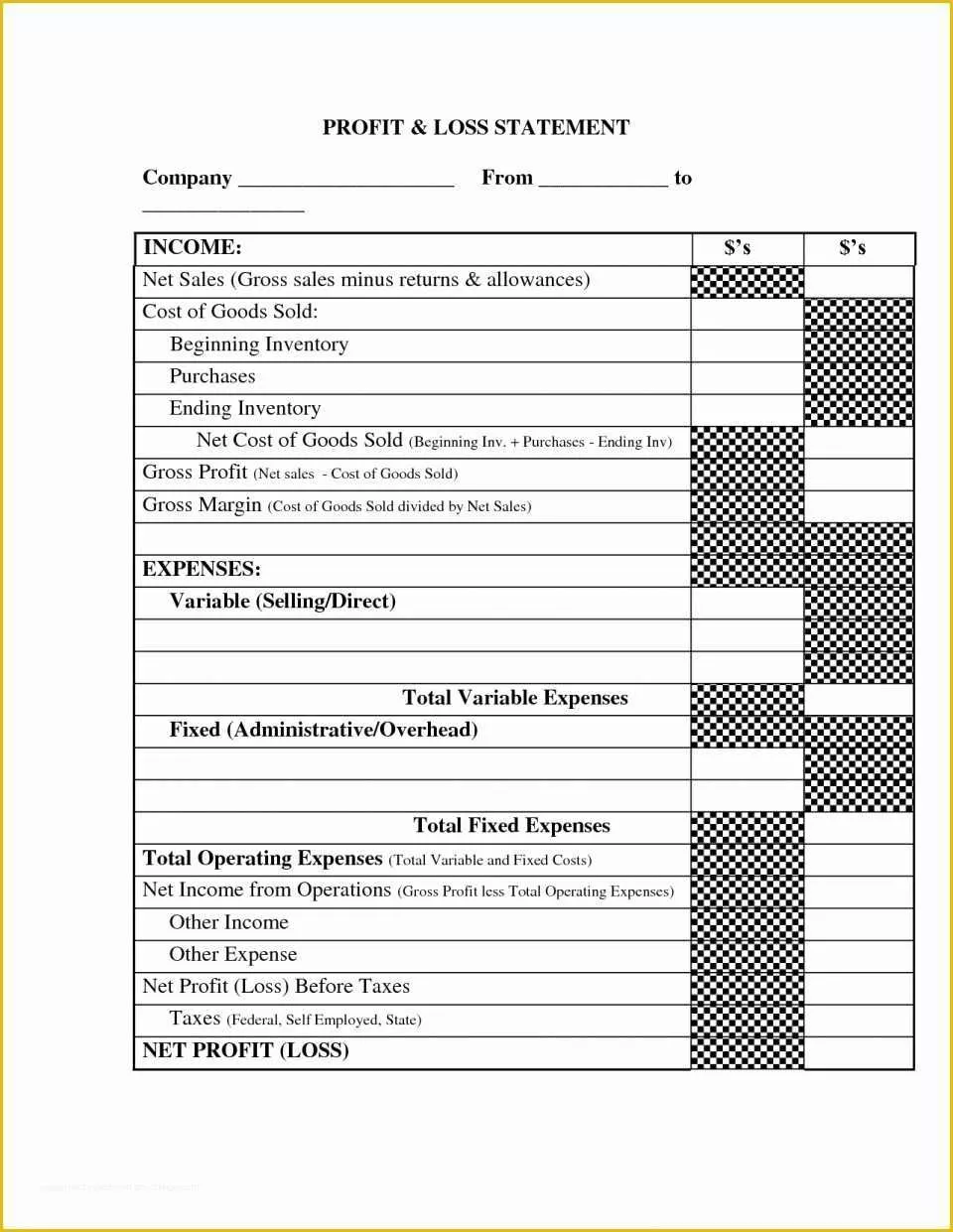

Key Components of YTD P&L Statement

When preparing a year-to-date profit and loss statement, there are several key components that you should include to ensure a comprehensive overview of your financial performance:

- Revenue: This section details the total income generated by your business during the specified period. It typically includes sales revenue, service revenue, and any other sources of income.

- Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold by your business. This may include raw materials, labor, and manufacturing expenses.

- Gross Profit: Gross profit is calculated by subtracting COGS from total revenue and reflects the profitability of your core business operations.

- Operating Expenses: Operating expenses encompass the day-to-day costs of running your business, such as rent, utilities, salaries, marketing, and administrative expenses.

- Net Profit/Loss: The bottom line of your YTD P&L statement, net profit or loss, is calculated by deducting total expenses from gross profit. A positive net profit indicates that your business is profitable, while a negative net profit signals a loss.

Interpreting YTD P&L Data

When analyzing your year-to-date profit and loss statement, it’s important to consider the following factors to gain a deeper understanding of your financial performance:

- Revenue Trends: Look for patterns in your revenue data to identify seasonal fluctuations, customer preferences, and overall sales performance. Analyzing revenue trends can help you forecast future sales and plan accordingly.

- Expense Management: Examine your operating expenses to identify areas where you can reduce costs or optimize spending. By managing expenses effectively, you can improve your bottom line and increase profitability.

- Profit Margin Analysis: Calculate your gross profit margin and net profit margin to assess the efficiency of your business operations. A higher profit margin indicates that your business is generating more profit from each sale.

- Variance Analysis: Compare your actual financial results to your budgeted numbers to understand the reasons behind any deviations. By analyzing variances, you can identify potential risks and opportunities for improvement.

Best Practices for YTD P&L Reporting

To ensure the accuracy and reliability of your year-to-date profit and loss statement, follow these best practices for financial reporting:

- Consistent Data Recording: Maintain accurate records of your financial transactions and update your YTD P&L statement regularly to reflect the most current information.

- Use Accounting Software: Utilize accounting software or financial management tools to streamline the process of preparing and analyzing your YTD P&L statement.

- Seek Professional Advice: Consult with a financial advisor or accountant to ensure that your YTD P&L statement complies with accounting standards and provides meaningful insights into your business’s financial performance.

- Regular Review and Analysis: Review your YTD P&L statement periodically to track your progress, identify trends, and make informed decisions based on your financial data.

By following these best practices, you can leverage the power of the year-to-date profit and loss statement to drive financial success and strategic growth for your business.

Year-to-date Profit And Loss Statement Template – EXCEL