Managing a business involves a lot more than just selling products or services. It requires a deep understanding of your financial health. One crucial tool that helps business owners understand their financial standing is the profit and loss statement.

Table of Contents

What Is a Profit and Loss Statement?

A profit and loss statement, also known as an income statement, is a financial document that summarizes your company’s revenue, expenses, and profits or losses over a specific period. It provides insights into your business’s financial performance, helping you identify areas of strength and weakness.

By analyzing this statement, you can make informed decisions to improve your company’s profitability.

How P&L Statements Work

Creating a profit and loss statement involves compiling all your revenue sources and deducting them from your expenses. The resulting figure is your net income or loss for the period.

This statement is usually prepared monthly, quarterly, or annually to track your financial progress over time. It allows you to compare your current performance with previous periods and make adjustments to achieve your financial goals.

Difference Between a P&L Statement and a Balance Sheet

While both profit and loss statements and balance sheets are essential financial documents for businesses, they serve different purposes and provide distinct insights into a company’s financial health. A profit and loss statement focuses on the company’s revenue, expenses, and profitability over a specific period, highlighting the operational performance of the business.

On the other hand, a balance sheet provides a snapshot of the company’s financial position at a specific point in time, detailing its assets, liabilities, and equity. It offers a broader view of the company’s financial health, including its liquidity, solvency, and overall net worth. By analyzing both documents together, business owners can gain a comprehensive understanding of their company’s financial performance and make strategic decisions to improve long-term sustainability.

Why You Need a Profit and Loss Statement?

A profit and loss statement is a critical tool for business owners for several reasons:

- Financial Analysis: It helps you analyze your company’s financial performance and make informed decisions based on data-driven insights.

- Budgeting: By tracking your revenue and expenses, you can create realistic budgets and financial forecasts to guide your business operations.

- Investor Relations: It provides valuable information to investors, lenders, and stakeholders about your company’s financial health and performance.

- Tax Preparation: Organizing your financial data in a profit and loss statement simplifies the process of filing taxes and ensures compliance with regulatory requirements.

Types of P&L Statements

There are several types of profit and loss statements, each serving different business needs:

- Single-Step Profit and Loss Statement. This simple report calculates net income by subtracting total expenses from total revenue. Commonly used by small businesses and startups, it groups all revenue and expenses into two categories—income and expenses—making it quick and easy to assess profitability for a specific period.

- Multi-Step Profit and Loss Statement. This format provides a detailed breakdown by separating operating and non-operating items. It includes sections like gross profit, operating income, and net income, helping business owners pinpoint strengths, weaknesses, and areas for strategic improvement.

- Contribution Margin Profit and Loss Statement. This type focuses on the contribution margin ratio, showing how sales revenue covers fixed costs and generates profit after variable costs. It’s useful for pricing decisions, cost control, and forecasting sales targets to boost long-term profitability.

Key Components of a Profit and Loss Statement

A typical profit and loss statement consists of the following key components:

1. Revenue

Revenue is the total income generated from the sale of goods or services by a business. It is a critical component of a profit and loss statement as it represents the primary source of income for the company. Revenue can be categorized into different streams, such as product sales, service fees, subscription revenue, and other sources of income.

The accurate recording of revenue is essential for calculating the overall profitability of the business and making informed decisions to drive growth and sustainability. By analyzing revenue trends over time, business owners can identify opportunities for revenue growth and optimize their sales strategies to maximize profitability.

2. Cost of Goods Sold (COGS)

The cost of goods sold (COGS) includes all direct costs associated with producing goods or services sold by a business. These costs typically include materials, labor, and overhead expenses directly related to the production process. Calculating the COGS is essential for determining the gross profit of the business.

Managing and controlling the cost of goods sold is crucial for maintaining profitability and competitiveness in the market. By optimizing production processes, negotiating better supplier deals, and monitoring inventory levels, businesses can reduce COGS and improve their overall profit margins.

3. Gross Profit

Gross profit is the difference between total revenue and the cost of goods sold. It represents the profit generated from the core business operations before deducting operating expenses. Gross profit is a key indicator of a company’s ability to generate revenue efficiently and cover production costs.

Monitoring gross profit margins is essential for assessing the profitability of different products or services offered by a business. By analyzing gross profit trends and identifying high-margin products or services, business owners can allocate resources effectively, streamline operations, and focus on revenue-generating activities to maximize profitability.

4. Operating Expenses

Operating expenses include all general and administrative costs incurred in running the day-to-day operations of a business. These expenses can encompass a wide range of items, such as rent, utilities, salaries, marketing expenses, and office supplies. Managing operating expenses is crucial for controlling costs and maximizing profitability.

Monitoring operating expenses relative to revenue is essential for assessing the efficiency of a business’s operations and identifying areas for cost reduction. By analyzing expense trends, business owners can implement cost-saving measures, negotiate better vendor contracts, and optimize resource allocation to improve overall financial performance.

5. Net Income

Net income, also known as net profit or the bottom line, is the final figure on a profit and loss statement after deducting all expenses from total revenue. It represents the overall profitability of a business for a specific period, indicating whether the company is making a profit or incurring losses.

Net income is a key performance metric for assessing the financial health and sustainability of a business. Positive net income indicates that a business is generating profits, while negative net income suggests that the business is operating at a loss. By analyzing net income trends and comparing them to industry benchmarks, business owners can make informed decisions to improve profitability and long-term success.

How to Create a Profit and Loss Statement

Creating a profit and loss statement involves the following steps:

1. Gather Financial Data

The first step in creating a profit and loss statement is to gather all relevant financial information, including sales revenue, expenses, and other income sources. This data can be obtained from accounting records, financial reports, invoices, and receipts. Ensuring the accuracy and completeness of financial data is essential for creating an informative and reliable profit and loss statement.

2. Categorize Revenue and Expenses

Once you have gathered the necessary financial data, the next step is to categorize your revenue and expenses into specific accounts or categories. Common revenue categories include product sales, service fees, interest income, and other sources of revenue. Expense categories may include cost of goods sold, payroll expenses, rent, utilities, marketing expenses, and other operating costs.

Organizing revenue and expenses into distinct categories helps you track and analyze the financial performance of your business more effectively. It also allows you to identify areas of strength and weakness in your revenue streams and expense management practices.

3. Calculate Gross Profit

After categorizing revenue and expenses, the next step is to calculate the gross profit of your business. To determine gross profit, subtract the cost of goods sold (COGS) from your total revenue. The resulting figure represents the profit generated from the core business operations before deducting operating expenses.

Gross profit is a key indicator of a business’s ability to generate revenue efficiently and cover production costs. Monitoring gross profit margins over time can help you assess the profitability of different products or services and make strategic decisions to improve overall financial performance.

4. Deduct Operating Expenses

Once you have calculated the gross profit, the next step is to deduct operating expenses from the gross profit to determine the net income of your business. Operating expenses include all general and administrative costs incurred in running the day-to-day operations of your business, such as rent, utilities, salaries, marketing expenses, and office supplies.

Determining the net income of your business is crucial for assessing overall profitability and financial health. Positive net income indicates that your business is generating profits, while negative net income suggests that your business is operating at a loss. By analyzing net income trends and identifying areas for cost reduction, you can make informed decisions to optimize profitability and achieve your financial goals.

5. Review and Analyze

Once you have completed your profit and loss statement, the final step is to review and analyze the results. Take the time to analyze revenue sources, expense categories, gross profit margins, and net income figures to gain insights into your business’s financial performance. Look for trends, anomalies, and areas for improvement that can help you make informed decisions to drive profitability.

Regularly reviewing and analyzing your profit and loss statement can provide valuable insights into your business’s financial health and help you identify opportunities for growth and optimization. By using this financial tool effectively, you can make strategic decisions that maximize profitability, improve operational efficiency, and achieve long-term success.

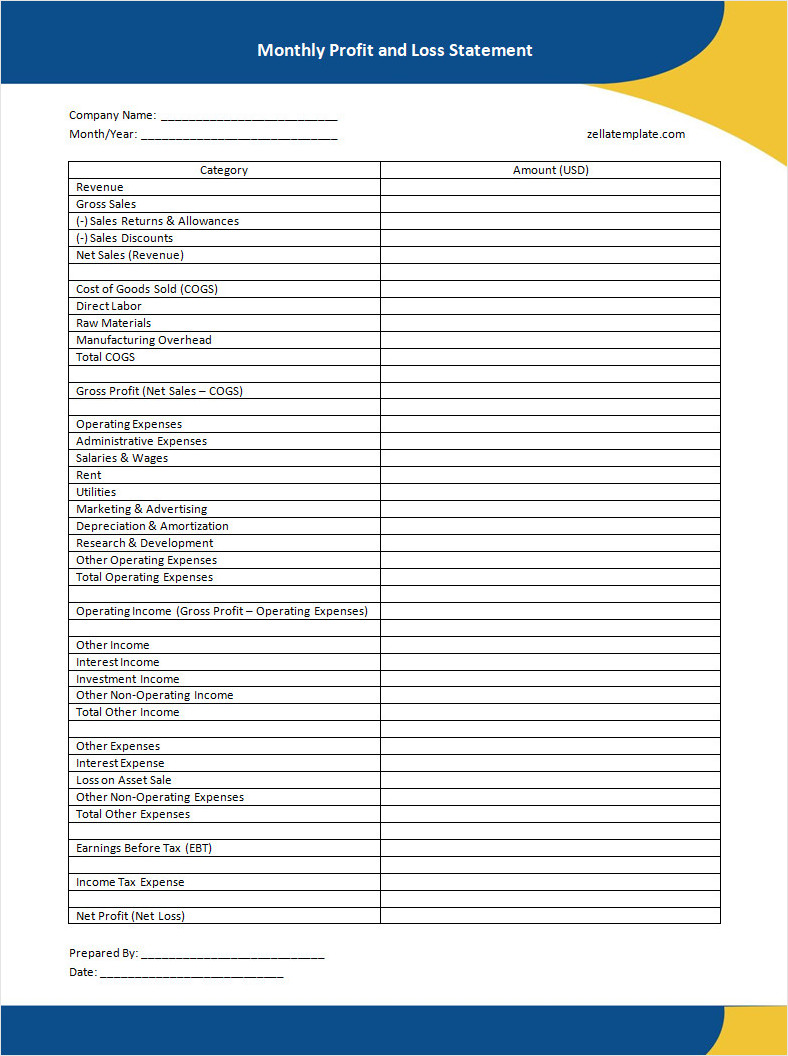

Profit and Loss Statement Template

Start using our free profit and loss statement template today to track income and expenses, evaluate financial performance, and make informed business decisions with confidence.

Profit and Loss Statement Template – Word