In today’s digital world of transactions and online banking, keeping track of your finances is more crucial than ever. One key tool that helps individuals and businesses alike manage their money is the bank statement.

Table of Contents

This formal record of all transactions in a bank account over a specific period provides valuable insights into financial activity, allowing account holders to track their finances, detect errors or fraud, monitor spending habits, reconcile their accounts, and serve as proof of financial activity for tasks like applying for loans or filing taxes.

What is a Bank Statement?

A bank statement is a document provided by a financial institution to an account holder that outlines all transactions made on a specific account over a set period. This can include deposits, withdrawals, transfers, fees, and any other activity related to the account. Bank statements are typically issued every month, but some institutions may offer the option for more frequent statements.

A bank statement provides a detailed overview of all financial activity within a specific account, presenting a clear snapshot of income, expenses, and overall cash flow. It is an essential tool for both personal and business financial management, helping account holders verify the accuracy of transactions, stay organized, and maintain control over their finances. By regularly reviewing bank statements, individuals and organizations can ensure that all activity is properly recorded and address any discrepancies promptly.

What is the Purpose of a Bank Statement?

The primary purpose of a bank statement is to provide transparency and accountability for all financial transactions related to a specific account. By regularly reviewing their bank statements, account holders can monitor their spending habits, track income and expenses, identify potential errors or discrepancies, and reconcile their accounts to ensure that their records match the bank’s records.

Additionally, bank statements serve as vital proof of financial activity for various tasks, such as applying for loans, mortgages, or credit cards, filing taxes, or resolving disputes with merchants or service providers. They offer a comprehensive overview of an individual’s or a business’s financial health and can help in making informed decisions about budgeting, investing, or saving.

The Importance of Financial Transparency

One of the key purposes of a bank statement is to provide financial transparency to the account holder. By detailing all transactions made on the account, bank statements offer a clear picture of where money is coming from and where it is going. This transparency allows individuals to understand their financial habits, identify areas for improvement, and make informed decisions about their money.

Proof of Financial Activity

Bank statements serve as crucial proof of financial activity for various tasks, such as applying for loans or mortgages. Lenders often require bank statements as part of the loan application process to verify an individual’s income, expenses, and overall financial stability. Bank statements can also be used as proof of income when filing taxes or applying for government benefits, making them a valuable tool for financial documentation.

Monitoring Spending Habits

Another important purpose of a bank statement is to help account holders monitor their spending habits. By reviewing their bank statements regularly, individuals can track where their money is going, identify unnecessary expenses, and make adjustments to their budgeting and saving plans. This monitoring can lead to more responsible financial behavior and better money management over time.

Reconciliation of Accounts

Bank statements play a crucial role in reconciling accounts between an individual’s records and the bank’s records. By comparing the transactions listed on their bank statement with their own records or receipts, account holders can ensure that all transactions are accurate and accounted for. This reconciliation process helps to identify any discrepancies or errors that may have occurred, allowing for timely resolution and peace of mind.

Detection of Errors or Fraud

One of the key purposes of a bank statement is to help account holders detect errors or fraudulent activity on their accounts. By carefully reviewing their bank statements for any unauthorized charges, discrepancies, or unusual transactions, individuals can identify potential issues and take action to resolve them. Promptly reporting any errors or suspicious activity to the financial institution can help prevent further financial loss and protect the account holder’s assets.

How a Bank Statement Works

When an account holder receives a bank statement, they can review all transactions listed on the document to verify the accuracy and completeness of the information. Each transaction will typically include details such as the date, description, amount, and type of transaction (e.g., deposit, withdrawal, transfer).

Account holders can compare their bank statement with their own records or receipts to ensure that all transactions match and that there are no unauthorized charges or errors. If any discrepancies are found, account holders should contact their financial institution immediately to investigate and resolve the issue.

Components of a Bank Statement

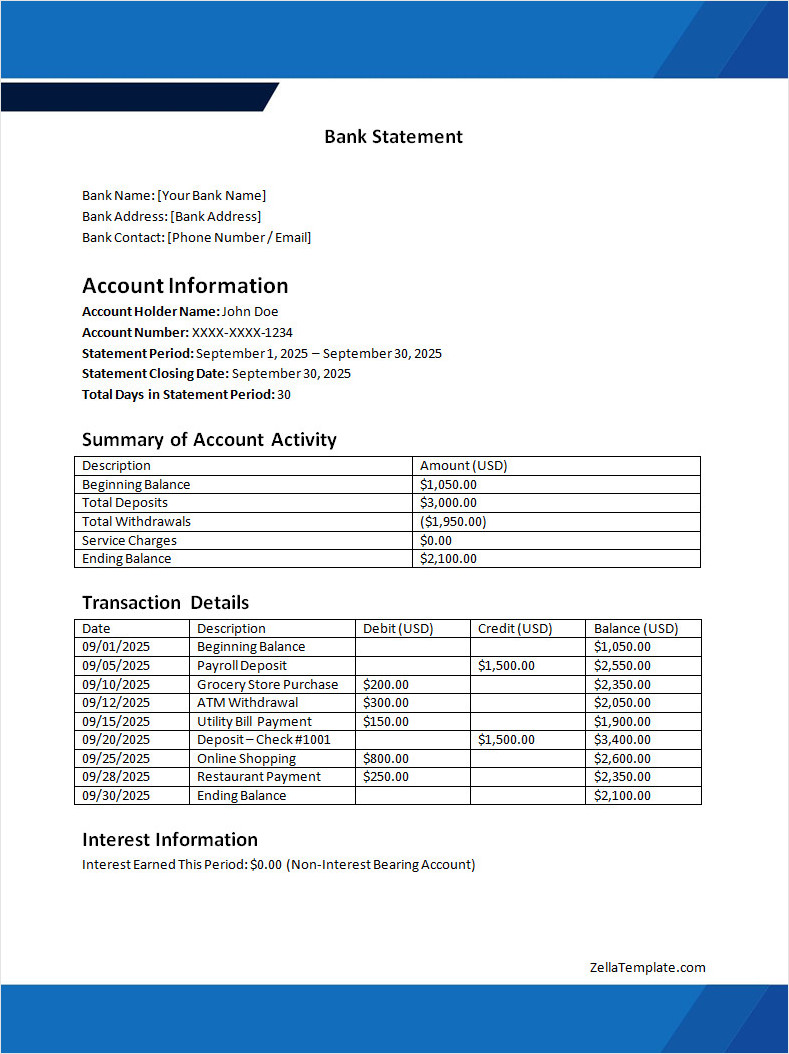

Bank statements typically include several key components that provide essential information about the account and its transactions. These components may vary slightly depending on the financial institution, but generally include:

- Account Information: Details about the account holder, account number, and account type.

- Transaction History: A detailed list of all transactions made on the account, including dates, descriptions, amounts, and types of transactions.

- Beginning and Ending Balances: The starting and ending balances for the statement period, showing the net change in the account balance.

- Fees: Any fees or charges incurred during the statement period, such as service fees, overdraft fees, or ATM fees.

- Interest Earned: If applicable, any interest earned on the account balance may be listed on the statement.

- Notes or Messages: Additional information or alerts from the financial institution regarding the account or transactions.

Bank Statement Template

A bank statement is a useful tool for organizing financial transactions in a clear and professional format. It helps record deposits, withdrawals, balances, and other account details, making it easier to track and manage finances.

To simplify your financial record-keeping, use our free bank statement template and create organized statements with ease!

Bank Statement Template – Word