What is a Blank Check Template?

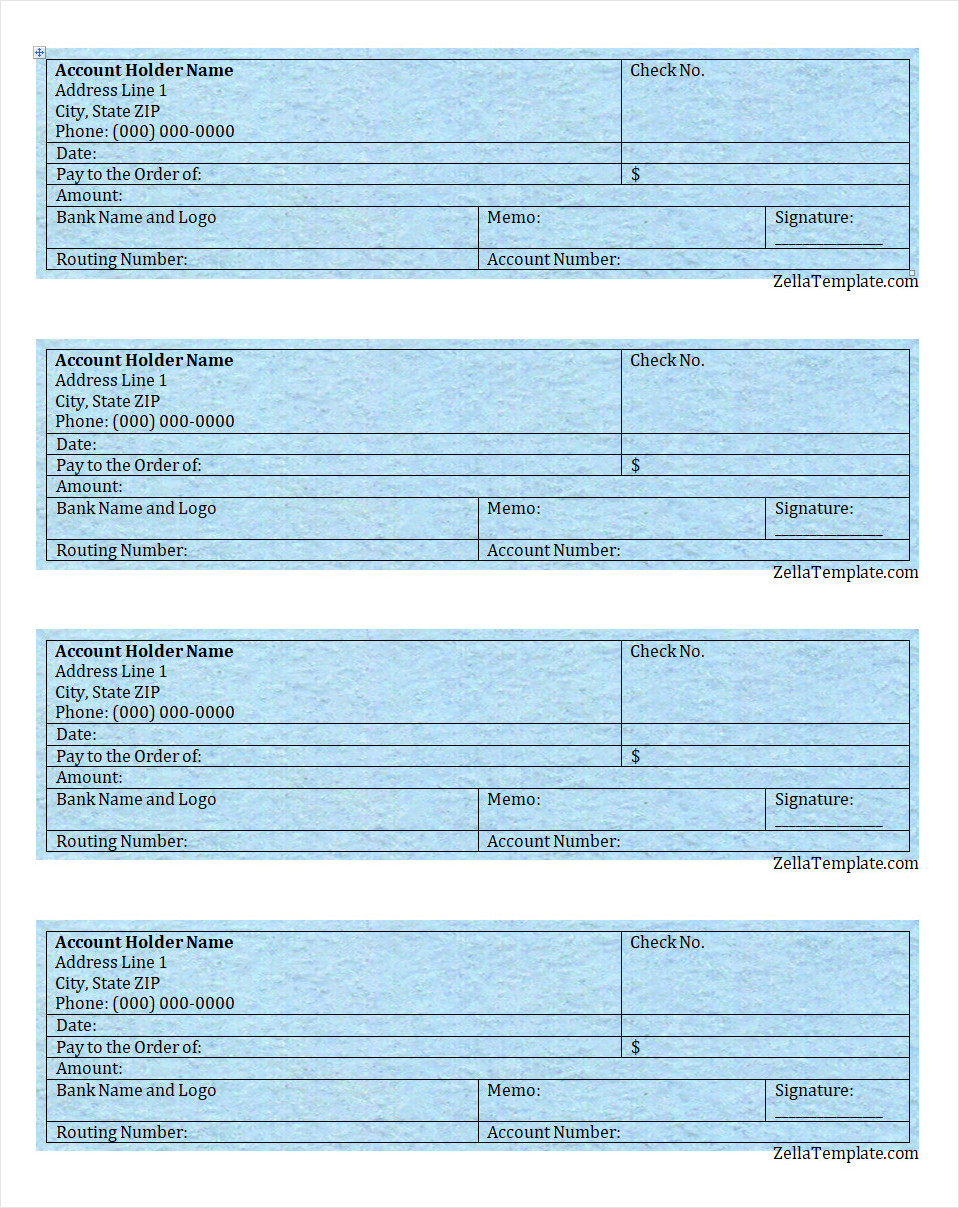

A blank check template is a pre-designed digital layout that mimics the appearance of a physical check but leaves out key details such as the payee’s name, amount, date, and signature. These templates provide a customizable foundation, allowing users to fill in their specific information as needed.

Table of Contents

When using a blank check template, it’s important to ensure compliance with legal standards. This includes filling out essential elements such as the payee’s name, the date, the amount (in both words and numbers), the memo line, and the signature line. Including these components helps create a check that is both valid and acceptable for use by banks and financial institutions.

Why Do You Need a Check Template?

1. Cost-Effectiveness

One of the primary reasons to use a check template is cost-effectiveness. Printing checks using a template is more affordable than ordering custom checks from banks or printing companies. These cost savings can be significant for individuals and businesses looking to manage their expenses efficiently.

2. Customization

Blank check templates offer a high level of customization, allowing users to tailor their checks to suit their unique needs and preferences. By adding branding elements, colors, and logos, users can create checks that reflect their identity and professionalism.

3. Convenience

Using a check template provides convenience, as users can create checks on demand without waiting for them to be delivered. This flexibility allows for quick and efficient check processing, making it easier to manage financial transactions and payments.

4. Control

By using a check template, users have full control over the design and content of their checks. This control ensures that the checks meet their specific requirements and align with their brand identity. Having control over the check design also allows for easy customization and updates as needed.

Types of Checks

1. Personal Checks

Individuals commonly use personal checks for financial transactions like paying bills, making purchases, or sending money to friends or family. These checks usually display the account holder’s name, address, and other personal details.

2. Payroll Checks

Payroll checks are issued by employers to employees as payment for their services. These checks include the employee’s name, payment amount, and other details related to the salary or wages earned.

3. Business Checks

Companies use business checks to make payments to vendors, suppliers, employees, and other business partners. These checks often feature the company’s name, address, logo, and other branding elements to present a professional image.

4. Traveler’s Checks

Traveler’s checks are a secure form of payment that can be used while traveling. These checks are pre-printed with a specific amount and can be replaced if lost or stolen, providing a safe and convenient payment option for travelers.

5. Cashier’s Checks

Cashier’s checks are issued by banks and are considered a secure form of payment. These checks are guaranteed by the bank and are often used for large purchases or transactions that require a high level of security.

Components of a Blank Check Template for Printing

1. Payee Name

The payee name is the individual or entity to whom the check is being issued. It is essential to accurately enter the payee’s name to ensure that the funds are directed to the correct recipient.

2. Date

The date on a check indicates when the payment was issued. It is crucial to enter the current date to prevent delays or confusion regarding the timing of the transaction.

3. Amount in Words and Figures

The amount of the payment should be written in both words and figures to prevent any discrepancies or alterations. This dual verification helps ensure the accuracy of the payment amount.

4. Memo Line

The memo line on a check provides additional information about the purpose of the payment. It can include details such as an invoice number, account number, or any other relevant information to help both the payer and payee track the transaction.

5. Signature Line

The signature line on a check is where the payer signs to authorize the payment. The signature is a crucial component of a check, as it verifies the authenticity of the transaction and makes the check legally binding.

Tips for Using Blank Check Templates

1. Use High-Quality Paper

When printing checks using a blank check template, it is essential to use high-quality paper to ensure the durability and security of the checks. High-quality paper can help prevent fraud and tampering, protecting the integrity of the checks.

2. Secure Your Templates

To prevent unauthorized access and misuse, it is essential to store blank check templates in a secure location. Keeping templates secure can help safeguard sensitive information and prevent potential fraud or unauthorized check printing.

3. Double-Check Information

Before printing a check using a blank check template, it is crucial to double-check all the information entered, including the payee name, amount, date, and signature. Verifying the accuracy of the details can help prevent errors and ensure that the check is processed correctly.

4. Keep Records

Maintaining a record of all checks issued using blank check templates is essential for tracking payments, reconciling accounts, and monitoring financial transactions. Keeping accurate records can help ensure transparency and accountability in financial management.

Impact of Considering Online Check Writing for Your Business

1. Efficiency and Streamlining

Online check writing services offer businesses a convenient and efficient way to create and send checks electronically. By using these services, businesses can streamline their payment processes, reduce manual tasks, and improve overall efficiency in financial transactions.

2. Cost Savings

Utilizing online check writing services can help businesses save money on check printing costs, as well as reduce the need for physical checks and postage. These cost savings can add up over time, resulting in significant financial benefits for companies looking to optimize their payment processes.

3. Enhanced Security Features

Online check writing services often include security features such as encryption, fraud detection, and user authentication to protect against unauthorized access and fraudulent activities. These security measures help safeguard sensitive financial information and ensure the integrity of financial transactions.

4. Compliance and Accuracy

By using online check writing services, businesses can ensure compliance with banking regulations and industry standards for check processing. These services help minimize errors, ensure accuracy in payment details, and maintain legal compliance in financial transactions.

Steps for Writing a Check

1. Fill in the Date

Start by entering the current date on the designated line on the check. The date indicates when the payment is issued and helps track the timing of the transaction.

2. Write the Payee’s Name

Write the name of the person or company to whom the check is being issued on the “Pay to the Order of” line. Ensure that the payee’s name is accurate to direct the funds to the correct recipient.

3. Specify the Amount

Write the payment amount in both words and figures on the designated lines on the check. This dual verification helps prevent discrepancies or alterations in the payment amount.

4. Add a Memo

Include a memo on the check if necessary to provide additional information about the purpose of the payment. The memo line can help both the payer and payee track and reconcile the transaction.

5. Sign the Check

Sign the check on the signature line to authorize the payment and make it legally binding. The signature verifies the authenticity of the transaction and ensures that the check is valid for processing.

6. Review and Confirm

Before issuing the check, review all the information entered, including the date, payee name, amount, memo, and signature. Confirm that all details are accurate and correct to prevent any errors or discrepancies in the transaction.

Blank Check Template

A blank check template is a practical tool for creating customizable checks for educational use, business training, or personal budgeting activities. It allows users to easily fill in details like payee, amount, date, and memo without designing a check from scratch.

Use our free Blank Check Template today to save time and ensure consistency in your check-related tasks. Fully editable and print-ready—perfect for teachers, trainers, small businesses, and personal finance use.

Blank Check Template – Word