When you receive your paycheck, you may notice a small slip of paper attached to it. This paper is known as a pay stub, and it holds valuable information about your earnings and deductions. Understanding your pay stub is essential for financial literacy and transparency in the workplace.

Table of Contents

Let’s dive into the world of pay stubs and uncover everything you need to know.

What Is a Pay Stub?

A pay stub, also known as a payslip or paycheck stub, is a document that outlines an employee’s earnings and deductions for a specific pay period. It provides a detailed breakdown of how wages are calculated, offering transparency into an employee’s compensation. Employers typically issue pay stubs alongside paychecks, giving employees a clear record of their income and payroll activity.

Pay stubs serve important functions for both employees and employers. For employees, they act as proof of income, support budgeting and financial planning, and are essential during tax preparation or loan applications. For employers, pay stubs help maintain accurate payroll records, ensure compliance with labor laws, and confirm that employees are paid correctly and on time.

What are Pay Stubs Used For?

Pay stubs serve multiple purposes for both employees and employers. For employees, pay stubs act as proof of income and provide a detailed record of their earnings. They can also be used for budgeting, tax filing, and applying for loans or mortgages. Employers use pay stubs to comply with labor laws, maintain accurate payroll records, and resolve any payment discrepancies.

1. Proof of Income

One of the primary uses of a pay stub is to serve as proof of income. Whether you are applying for a loan, renting an apartment, or filing your taxes, your pay stub provides documentation of your earnings. Lenders and financial institutions often require pay stubs to verify your income and assess your ability to repay debts.

2. Budgeting and Financial Planning

Pay stubs are valuable tools for budgeting and financial planning. By reviewing your pay stubs regularly, you can track your income, expenses, and savings over time. Understanding how much you earn, how much is deducted for taxes and other expenses, and what your net pay is can help you create a budget that aligns with your financial goals.

3. Tax Filing

During tax season, your pay stubs play a crucial role in filing your taxes accurately. They provide information on your earnings, taxes withheld, and any deductions that may impact your tax liability. By having access to your pay stubs, you can ensure that you report your income correctly and take advantage of any tax deductions or credits you may be eligible for.

4. Loan and Mortgage Applications

When applying for a loan or mortgage, lenders often require pay stubs to assess your income stability and repayment capacity. Your pay stubs offer insight into your regular income, which lenders use to evaluate your creditworthiness. Having accurate and up-to-date pay stubs can expedite the loan approval process and increase your chances of securing financing.

Why Is a Pay Stub Important?

1. Transparency and Accountability

Pay stubs promote transparency and accountability in the workplace by giving employees a clear view of their financial transactions. By reviewing their pay stubs, employees can verify that they are being paid the correct amount, understand the breakdown of their earnings, and identify any errors or discrepancies that may require correction.

2. Legal Compliance

Employers are required by law to provide employees with accurate pay stubs that comply with labor regulations. Pay stubs serve as legal documents that outline the terms of employment, including wages, deductions, and benefits. Failure to provide employees with pay stubs that meet legal requirements can result in penalties, fines, or legal action against the employer.

3. Financial Planning and Decision-Making

Understanding your pay stub is essential for effective financial planning and decision-making. By knowing how much you earn, how much is deducted for taxes and other expenses, and what your take-home pay is, you can make informed choices about budgeting, saving, investing, and spending. Pay stubs provide the financial data you need to manage your finances responsibly.

4. Dispute Resolution

If you believe there is an error in your pay or deductions, your pay stub serves as a valuable reference for resolving disputes. By comparing your pay stub to your contract, work hours, and other relevant documents, you can identify discrepancies and bring them to the attention of your employer. Pay stubs facilitate open communication and transparency in resolving payment issues.

What Information is On a Pay Stub?

A typical pay stub contains various sections that outline different components of your compensation:

1. Gross Pay

Gross pay is the total amount you earn before any deductions, including taxes, are taken out. It includes your base salary or hourly wage, along with bonuses, commissions, and overtime pay. Gross pay serves as the starting point for determining your net pay.

2. Taxes Withheld

Taxes withheld on your pay stub show the federal, state, and local income taxes your employer deducts from your earnings. Your employer withholds these taxes based on your income, filing status, and other factors, ensuring you meet your tax obligations throughout the year.

3. Net Pay

Also known as take-home pay, it is the money you receive after subtracting all deductions, including taxes, from your gross pay. It’s the amount you can use for living expenses, savings, and personal spending. Knowing your net pay helps you budget wisely and plan for your financial goals.

4. Employee Details

Your pay stub includes personal details such as your name, address, and employee identification number. These details help identify the pay stub as belonging to you and ensure that your earnings are accurately attributed to your account. It is important to review your personal information on your pay stub to confirm its accuracy and notify your employer of any discrepancies.

5. Pay Period

The pay period on your pay stub indicates the dates covered by the earnings and deductions reflected in the document. Pay periods can be weekly, bi-weekly, semi-monthly, or monthly, depending on your employer’s payroll schedule. Knowing the pay period allows you to track your income over specific time frames and compare it to your expenses or budget cycle.

6. Deductions

Additional deductions on your pay stub can include various items such as healthcare premiums, retirement contributions, insurance premiums, union dues, or other voluntary withholdings. These deductions reduce your gross pay and impact your net pay. Understanding the purpose and amount of each deduction helps you assess your overall financial picture and make informed decisions about your finances.

How Long Should Employers Keep Pay Stubs?

Employers must keep accurate payroll records, including pay stubs, for a specific period to comply with labor laws. While the required retention period varies by state, it’s generally recommended to keep pay stubs for at least three to seven years. This allows both employers and employees to access past payment information when needed.

Do States Require Employers To Provide Pay Stubs?

Most states in the U.S. do not have specific laws mandating that employers provide pay stubs to employees. However, many states have regulations that require employers to keep accurate payroll records and provide employees with access to their pay information upon request. It is always advisable to check your state’s labor laws regarding pay stub requirements.

Tips to Create a Pay Stub

For employers looking to create pay stubs for their employees, here are some tips to ensure accuracy and compliance:

1. Use Payroll Software

Employers should invest in reliable payroll software to automatically generate accurate pay stubs. This software streamlines the creation process, minimizes errors, and ensures all required details appear on each document. By using technology, employers can simplify payroll management and deliver clear, consistent pay stubs to employees.

2. Include All Necessary Information

Make sure to include employee details, earnings, deductions, and taxes withheld on the pay stub. Accuracy and completeness are key when creating pay stubs, as they serve as legal documents and proof of payment. Double-check all information before distributing pay stubs to employees to avoid any discrepancies or misunderstandings that could impact employee trust and satisfaction.

3. Double-Check for Errors

Review pay stubs for any discrepancies or mistakes before distributing them to employees. Errors in pay stubs can lead to confusion, frustration, and potential disputes between employers and employees. By conducting thorough quality checks and validation processes, employers can identify and correct errors before pay stubs are issued, ensuring accurate and reliable documentation.

4. Provide Online Access

Consider offering employees online access to their pay stubs for convenience and transparency. Online portals or digital platforms allow employees to view and download their pay stubs at any time, from any location. Providing online access to pay stubs enhances employee self-service, reduces administrative burdens, and promotes efficient communication between employers and employees.

5. Stay Updated with Labor Laws

Regularly review and comply with state and federal labor laws regarding pay stub requirements. Labor laws may change over time, impacting the content, format, and delivery of pay stubs. By staying informed about legal requirements and industry best practices, employers can ensure that their pay stubs are accurate, compliant, and aligned with current regulations. Prioritize ongoing training and education on pay stub compliance to mitigate risks and promote ethical payroll practices.

6. Communicate Clearly

When providing pay stubs to employees, communicate clearly about the information included on the document, its purpose, and how to interpret it. Address any common questions or concerns employees may have about their pay stubs, such as deductions, tax withholdings, or payment calculations. By fostering open communication and transparency around pay stubs, employers can enhance employee understanding and confidence in their compensation.

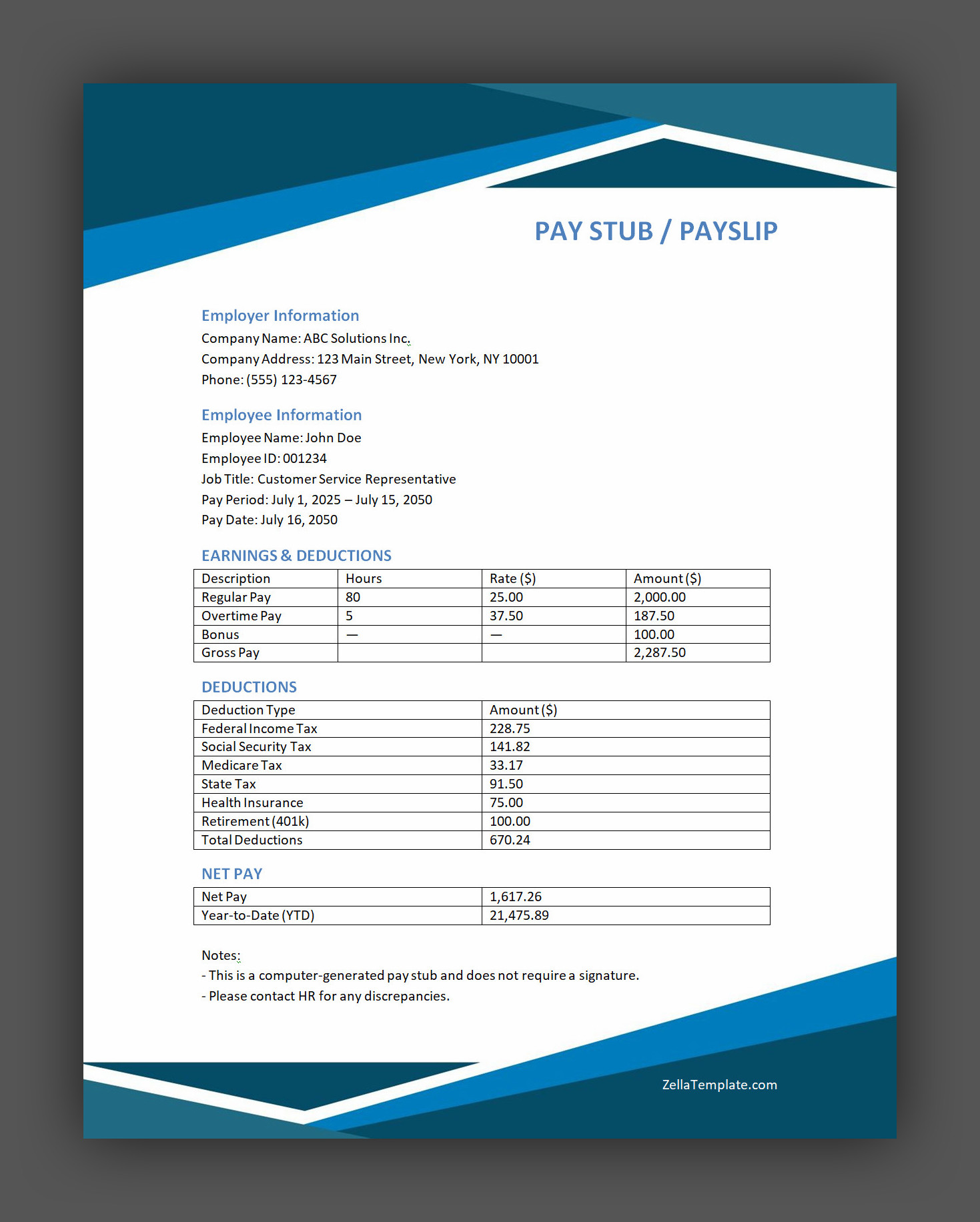

Pay Stub Template

Providing accurate and professional pay stubs is essential for transparency and recordkeeping for both employers and employees. A well-formatted pay stub makes it easy to outline wages, deductions, taxes, and net pay, helping you stay compliant and organized.

Use our free pay stub template today to streamline your payroll process. Fully customizable and ideal for small businesses, freelancers, or anyone who needs to generate clear, printable pay stubs with ease.

Pay Stub Template – Word