Table of Contents

When borrowing or lending money, having a clear understanding of the terms and conditions is essential to avoid any misunderstandings or disputes in the future. One way to formalize a loan agreement and ensure both parties are on the same page is through a promissory note. This legally binding document acts as a written promise to repay borrowed money, outlining the key details of the loan such as the principal amount, interest rate, and repayment schedule.

In this comprehensive guide, we will delve into the world of promissory notes, exploring how they work, why they are important, and what key elements make them effective in financial agreements.

What is a Promissory Note?

A promissory note is a written document that serves as a binding contract between a lender and a borrower. It is a legal instrument that formalizes the terms of a loan agreement, providing clarity and security for both parties involved. Essentially, it outlines the specifics of the loan, including the amount borrowed, the interest rate charged, the repayment schedule, and any other relevant terms and conditions.

Unlike an IOU (I Owe You), which is a simple acknowledgment of debt, it is a more formal and detailed document that offers protection and enforceability in case of default. By signing a promissory note, both the lender and the borrower agree to adhere to the terms laid out in the document, making it a crucial tool in financial transactions.

The Legal Nature of Promissory Notes

One of the key aspects of a promissory note is its legal nature. It is a legally binding documents that establish a clear agreement between the lender and the borrower. This legal nature provides a sense of security and enforceability for both parties, as they have legal recourse in case of default.

When both parties sign a promissory note, they create a legal contract that outlines the loan’s terms and conditions. If the borrower fails to meet their obligations, either party can use the document in court to enforce repayment. This legal structure protects both parties and ensures that the loan terms are honored.

Types of Promissory Notes

Several types of promissory notes can be used depending on the specific circumstances of the loan agreement. Some common types include:

- Secured Promissory Note: It is backed by collateral, such as real estate or personal property, which the lender can seize in case of default.

- Unsecured Promissory Note: It does not require any collateral and relies solely on the borrower’s creditworthiness to repay the loan.

- Conditional Promissory Note: It includes specific conditions that must be met by the borrower for the loan to be valid, such as obtaining a certain credit score or fulfilling certain obligations.

- Fixed-Rate Promissory Note: It has a set interest rate that does not change throughout the term of the loan.

- Variable-Rate Promissory Note: It has an interest rate that fluctuates based on market conditions.

- Demand Promissory Note: It allows the lender to demand repayment of the loan at any time.

- Installment Promissory Note: It requires the borrower to make regular payments over a specified period until the loan is fully repaid.

Each type has its advantages and considerations, depending on the specific requirements of the loan agreement and the preferences of the parties involved.

How Promissory Notes Work

When a borrower seeks a loan, the lender may require them to sign a promissory note as part of the agreement. This note outlines the loan amount, interest rate, repayment schedule (including payment frequency and due dates), and any additional terms both parties agree upon.

Once the borrower signs the promissory note, it becomes a legally binding contract. The borrower must repay the loan according to the specified terms. If the borrower defaults, the lender can use it as evidence to take legal action and recover the debt.

Importance of a Promissory Note in Financial Agreements

A promissory note plays a crucial role in formalizing and documenting a loan agreement between a lender and a borrower. By clearly outlining the terms and conditions of the loan, a promissory note provides clarity and security for both parties involved. Here are some key reasons why promissory notes are important in financial agreements:

1. Legal Protection and Enforceability

One of the key reasons promissory notes are important in financial agreements is their legal enforceability. As legally binding contracts, they hold both the borrower and lender accountable for the terms outlined in the agreement. If the borrower defaults, the lender can take legal action to recover the debt using the promissory note as evidence.

This legal protection gives lenders confidence that they have recourse in case of non-payment. At the same time, borrowers benefit from a clearly defined agreement that safeguards their rights and ensures fair treatment in the event of a dispute.

2. Clarity and Understanding

Another important aspect of promissory notes is the clarity they provide in outlining the terms and conditions of the loan agreement. By clearly stating the amount borrowed, the interest rate, the repayment schedule, and any other relevant details, promissory notes help both parties understand their obligations and responsibilities.

Having a clear and detailed promissory note helps prevent misunderstandings and disputes between the lender and the borrower. By ensuring that both parties are on the same page regarding the terms of the loan, promissory notes contribute to a transparent and mutually beneficial financial agreement.

3. Record Keeping and Documentation

Additionally, promissory notes serve as important documentation of the loan agreement, providing a record of the terms and conditions agreed upon by the lender and the borrower. This documentation can be valuable in tracking payments, monitoring the status of the loan, and resolving any potential disputes that may arise during the repayment process.

By keeping a well-maintained promissory note, both parties have a clear record of their obligations and commitments, making it easier to refer back to the terms of the loan agreement if needed. This documentation can also be useful for tax purposes, financial planning, and other administrative tasks related to the loan.

Key Elements of an Effective Promissory Note

For a promissory note to be effective and legally enforceable, it should include certain key elements that are essential to the loan agreement. Some of the key elements of an effective promissory note include:

1. Principal Amount

The principal amount is the total sum the borrower receives from the lender. It forms the foundation of the loan and is the main amount the borrower agrees to repay. The promissory note must clearly state this amount to prevent misunderstandings or disputes.

Both parties should agree on the principal before signing the note to ensure the loan terms are accurate. By specifying the principal, the promissory note defines the core repayment obligation and establishes a clear basis for the agreement.

2. Interest Rate

The interest rate is the percentage of the principal that the borrower pays the lender as compensation for using the borrowed funds. It is a key component of a promissory note, as it affects the total cost of the loan for the borrower and the lender’s expected return.

Promissory notes may include different types of interest rates, such as fixed, variable, or balloon rates. The note should clearly state the applicable rate, along with relevant details like the compounding frequency, to ensure both parties fully understand the borrowing cost and repayment terms.

3. Repayment Schedule

The repayment schedule outlines how and when the borrower will repay the loan. It includes the frequency of payments (e.g., monthly or quarterly), due dates, and the total number of installments required to fully repay the debt.

A clearly defined repayment schedule in the promissory note helps prevent misunderstandings and allows both parties to manage their finances and expectations effectively.

4. Collateral

Collateral is an asset that the borrower pledges to secure a loan. If the borrower defaults on the loan, the lender has the legal right to seize the collateral to recover the owed amount. This added layer of protection reduces the lender’s risk and increases the likelihood of repayment.

When a promissory note is secured by collateral, the agreement should identify the asset, include its estimated value, and specify the conditions under which the lender may take possession. Properly documenting these details ensures transparency and legal enforceability for both parties.

5. Events of Default

Events of Default are specific conditions outlined in a promissory note that, if violated by the borrower, trigger a default on the loan. Common events include missed payments, breach of contract terms, or borrower insolvency.

Including these events in the note ensures both parties understand what constitutes a default and the potential consequences. This clarity protects the lender’s interests and reinforces the borrower’s obligations under the loan agreement.

6. Governing Law

The governing law clause identifies the state laws that will apply to the interpretation and enforcement of the promissory note. This clause is essential because it determines the legal framework for resolving any disputes that may arise from the agreement.

By including this clause, both the lender and borrower agree in advance on which jurisdiction’s laws will apply, providing clarity, consistency, and predictability in the event of legal issues.

When to Use a Promissory Note?

A promissory note can be used in a variety of situations where money is being borrowed or lent. Some common scenarios where a promissory note may be used include:

1. Personal Loans

Personal loans between friends or family members are common scenarios where a promissory note can be especially beneficial. When borrowing money from a loved one, it’s important to formalize the arrangement with a written agreement to ensure both parties clearly understand the terms and to help prevent future misunderstandings or conflicts.

A well-drafted promissory note for a personal loan should include key details such as the principal amount, interest rate (if any), repayment schedule, and any other mutually agreed-upon terms. This document adds a layer of formality and legal protection for both the lender and the borrower.

2. Business Loans

Business loans often involve larger amounts and more complex terms than personal loans. When a business secures funding from a lender or investor, a promissory note is commonly used to formalize the agreement and outline the terms of repayment.

For such loans, it should specify the principal amount, interest rate, repayment schedule, and any collateral used to secure the loan. Documenting these terms in writing helps both parties ensure that the agreement is transparent, enforceable, and legally binding.

3. Real Estate Transactions

Real estate transactions—such as purchasing property or securing a mortgage—often involve substantial financial commitments and complex arrangements. In these cases, a promissory note is commonly used to formalize the loan agreement between the buyer and the seller or lender.

It should outline all essential loan terms, including the principal amount, interest rate, repayment schedule, and any conditions tied to the property. By putting these terms in writing, both parties can protect their interests, minimize misunderstandings, and ensure that the loan agreement is legally sound and enforceable.

4. Student Loans

Student loans are a common method of financing higher education expenses. When students borrow from private lenders or government agencies, they are typically required to sign a promissory note that outlines the loan’s terms and repayment obligations.

A student loan promissory note generally includes key details such as the loan amount, interest rate, repayment schedule, and any specific provisions or deferment options. By signing the promissory note, students legally commit to repaying the loan according to the agreed-upon terms, helping to ensure accountability and clarity for both the borrower and the lender.

5. Car Loans

Car loans are a common method of financing vehicle purchases, with the vehicle itself often used as collateral to secure the loan. When taking out a car loan, borrowers are usually required to sign a promissory note that details the loan’s terms and conditions, including the repayment schedule, interest rate, and any provisions related to default.

It should include essential details such as the principal amount, interest rate, repayment schedule, and any specific conditions related to the vehicle, such as title transfer or repossession terms in the event of default. By formalizing the agreement, both the lender and the borrower establish a clear understanding of their rights and responsibilities.

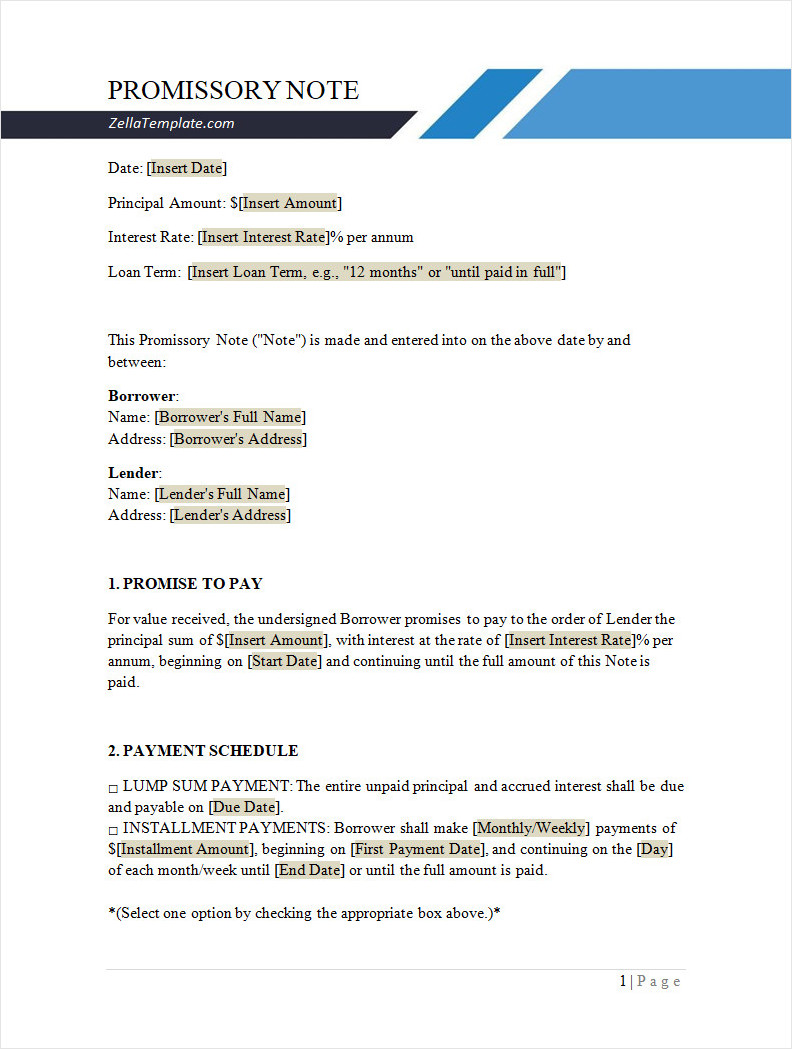

Free Promissory Note Template

A promissory note is a vital document that clearly outlines the terms of a loan, protecting both the lender and the borrower. Whether you’re lending money to a friend, financing a business deal, or formalizing a personal loan, having a written agreement ensures transparency and legal security.

Use our free promissory note template today to create a clear, professional, and legally sound loan agreement. Fully customizable and easy to use—ideal for personal, business, or legal use.

Promissory Note Template – Word